Why Fundamental Analysis is Crucial for Successful Trading

Trading success is often depicted as the mastery of complex chart patterns and technical indicators. However, while technical analysis is a vital tool, the cornerstone of truly successful trading lies in understanding the broader economic landscape through fundamental analysis. In this blog post, we explore how fundamental analysis complements technical analysis, offering a holistic approach to trading. We also discuss how FXC Academy provides fundamental insights through its memberships.

The Role of Fundamental Analysis

Fundamental analysis involves examining economic indicators, news events, and market sentiment to understand the intrinsic value of a currency or financial asset. Unlike technical analysis, which focuses on price patterns and market trends, fundamental analysis provides insights into the underlying factors driving market movements.

Gross Domestic Product (GDP):

Indicates the health of an economy. Strong GDP growth often leads to a stronger currency as it attracts foreign investment.

Employment Data:

Metrics like the Non-Farm Payroll (NFP) report in the US can significantly impact currency value. High employment rates usually correlate with economic strength.

Inflation Rates:

Central banks monitor inflation to set interest rates. Higher inflation can lead to higher interest rates, boosting the currency’s value.

Interest Rate:

Changes in interest rates directly affect currency strength. Higher interest rates attract foreign investors looking for the highest return on their investments.

Geopolitical Events:

Political stability, elections, and international conflicts can cause significant market fluctuations.

Central Bank Announcements:

Statements and policy changes from central banks like the Federal Reserve or European Central Bank can lead to market volatility.

Trade Agreements and Tariffs:

These can affect currency values by impacting economic growth prospects and trade balances.

Investor Confidence:

Sentiment indicators, such as consumer confidence indices, can provide insights into future economic activity and currency movements.

Complementing Technical Analysis with Fundamental Analysis

While technical analysis provides a snapshot of market trends and price movements, fundamental analysis gives context to these movements. Combining both approaches offers a comprehensive trading strategy.

Confirming Trends:

Use fundamental analysis to confirm trends identified through technical analysis. For instance, a bullish trend supported by strong economic data and central bank policies is more reliable.

Identifying Trading Opportunities:

Fundamental analysis can highlight potential trading opportunities before they become apparent on the charts. For example, anticipating a central bank rate hike can position a trader ahead of market moves.

Risk Management:

Understanding the fundamental reasons behind market moves can help manage risk more effectively. Traders can avoid entering trades based solely on technical signals without considering underlying economic conditions.

Event-Driven Trading:

Fundamental analysis is crucial for event-driven trading strategies. Major economic releases and geopolitical events often cause sharp market movements, and being prepared can lead to profitable trades.

Integrate Analysis:

Develop a trading plan that incorporates both technical and fundamental analysis. Use technical indicators to identify entry and exit points, while using fundamental analysis to validate these points..

Be Flexible:

Adapt your strategy as new information becomes available. Flexibility ensures that you can respond to both technical signals and fundamental shifts.

How FXC Academy Provides Fundamental Insights

At FXC Academy, we emphasize the importance of a holistic trading approach by offering comprehensive fundamental analysis insights as part of our memberships.

Real-Time Updates:

Receive real-time updates and alerts on important news events and economic releases, ensuring you are always informed about market-moving developments.

Educational Resources:

Access a wealth of educational materials, including video, articles, and charts on fundamental analysis, designed to enhance your trading knowledge and skills.

Expert Analysis:

Our team of experienced analysts provides in-depth analysis of economic indicators, central bank policies, and geopolitical events, helping members stay ahead of market trends.

Community Support:

Join a community of traders who share insights and strategies, fostering a collaborative environment where you can learn from others’ experiences and improve your trading approach.

Conclusion

Fundamental analysis is indeed the cornerstone of successful trading, providing invaluable insights that complement technical analysis. By understanding economic indicators, news events, and market sentiment, traders can make more informed decisions and develop robust trading strategies. FXC Academy offers the tools and resources needed to integrate fundamental analysis into your trading, ensuring a well-rounded and successful approach.

How to Maintain Consistency in Trading: Key Tips for Success

Consistency is a cornerstone of successful trading. Maintaining a disciplined approach and avoiding impulsive decisions can significantly improve long-term trading outcomes. In this blog post, we’ll explore tips and techniques for maintaining consistency in trading and discuss how mentoring at FXC Academy can help traders stay accountable and adhere to a data-driven approach.

The Importance of Consistency in Trading

Consistency in trading involves sticking to a well-defined strategy, managing risks effectively, and making informed decisions based on data rather than emotions. It helps in:

Achieving Long-Term Success:

Consistent execution of a trading plan leads to steady performance and long-term profitability.

Reducing Emotional Impact:

A disciplined approach minimizes the influence of emotions like fear and greed, which can lead to impulsive and often detrimental decisions.

Building Confidence:

Knowing that you are following a proven strategy can enhance confidence and reduce stress, leading to better decision-making.

Tips and Techniques for Maintaining Consistency

Develop and Stick to a Trading Plan:

Create a detailed trading plan that includes your trading goals, risk tolerance, entry and exit strategies, and criteria for selecting trades.

Set Realistic Goals:

Establish achievable and specific trading goals. Unrealistic expectations can lead to frustration and impulsive decisions. Realistic goals help maintain focus and motivation.

Implement Risk Management Strategies:

Use stop-loss orders and position sizing techniques to manage risk. Never risk more than you can afford to lose on a single trade.

Maintain a Trading Journal:

Keep a detailed record of all your trades, including the rationale behind each trade, the outcome, and any lessons learned. Reviewing your journal regularly can help identify patterns and areas for improvement. Stay informed about market trends, new trading strategies, and economic news. Continuous learning helps you adapt to changing market conditions and refine your trading approach.

Limit Emotional Influence:

Develop techniques to manage emotions, such as mindfulness, meditation, or taking breaks during stressful times. Emotional control is key to consistent trading.

How Mentoring at FXC Academy Can Help

At FXC Academy, we understand that maintaining consistency is challenging, especially for new traders. Our mentoring programs are designed to provide the support and accountability needed to stay disciplined and data-driven.

Personalized Mentorship:

Our experienced mentors offer one-on-one guidance, helping you develop and stick to your trading plan. Personalized mentorship ensures that you receive tailored advice and support.

Regular check-ins and progress reviews with your mentor help you stay accountable to your trading goals and strategies. This accountability is crucial for maintaining consistency.

Data-Driven Approach:

At FXC Academy, we emphasize a data-driven approach to trading. Our mentors help you analyze market data, refine your strategies based on performance metrics, and make informed decisions.

Continuous Education:

We provide access to a wealth of educational resources, including webinars, workshops, and trading courses. Continuous education helps you stay updated with the latest market trends and strategies.

Community Support:

Join a community of like-minded traders who share their experiences, insights, and support. Engaging with a community fosters motivation and discipline.

Conclusion

Maintaining consistency in trading is essential for achieving long-term success. By developing a solid trading plan, practicing patience and discipline, and leveraging risk management strategies, traders can improve their performance and reduce emotional influence. Mentoring at FXC Academy offers the support, accountability, and data-driven approach needed to stay consistent and succeed in the Forex market.

Ready to enhance your trading consistency? Join FXC Academy today and take the first step towards disciplined and profitable trading.

Seasonality and Cyclical Analysis in the Forex Market

In the Forex market, understanding and leveraging seasonal and cyclical patterns can be a game-changer for traders. These patterns provide insights into predictable trends and behaviors that occur at specific times of the year, influenced by various factors such as economic cycles, calendar effects, and market sentiment. In this blog post, we’ll delve into how to analyze seasonal and cyclical patterns, identify common trends, and apply this knowledge to enhance your trading strategy.

Understanding Seasonality in Forex

Seasonality refers to the predictable changes in currency prices that occur at certain times of the year. These patterns can result from factors like changes in economic activity, fiscal policies, and investor behavior.

Seasonal Trends:

– Gold in December:

Historically, gold prices tend to rise in December. This could be attributed to increased demand for gold during the holiday season and end-of-year financial planning.

– August Slowdown:

Forex markets often experience reduced volatility and volume in August as many traders and financial institutions take vacations, leading to less market activity.

Calendar Effects:

– End-of-Month Rebalancing:

Institutional investors often rebalance their portfolios at the end of the month, which can lead to predictable movements in currency pairs.

– Quarterly Reports and Earnings Seasons:

Significant financial reporting periods can influence currency values as markets react to corporate earnings and economic data releases.

Analyzing Cyclical Patterns

Cyclical analysis involves studying the longer-term cycles that influence currency movements, driven by economic and business cycles, geopolitical events, and central bank policies.

Economic Cycles:

Currencies tend to perform differently during various phases of the business cycle (expansion, peak, contraction, trough). For instance, commodity currencies like the Australian dollar may strengthen during economic expansions due to higher demand for raw materials.

Cyclical Indicators:

– Interest Rate Cycles:

Central banks’ interest rate policies are cyclical. For example, a cycle of rate hikes by the Federal Reserve typically strengthens the US dollar.

– Commodity Price Cycles:

Currencies of commodity-exporting countries (e.g., Canada, Australia) are heavily influenced by the cycles of key commodities like oil and metals.

Applying Seasonal and Cyclical Analysis

To effectively use seasonal and cyclical patterns in your trading strategy, consider the following steps:

Historical Data Analysis:

Review historical price data to identify recurring seasonal and cyclical patterns. Tools like seasonal charts and economic calendars can be valuable resources. This needs to be at least 5-10 years worth of confirming data to call it a seasonal pattern for a currency.

Combine with Technical Analysis:

Use technical indicators in conjunction with seasonal and cyclical patterns to confirm potential trade opportunities. For instance, if historical data shows the British pound tends to rise in Q4, look for technical signals that support this trend. You can therefore adjust trade management as well as longevity of a trade in seasonal patterns.

Monitor Economic Indicators:

Stay informed about economic indicators and central bank announcements that can influence cyclical trends. Understanding the macroeconomic context helps in anticipating potential market movements.

Join FXC Academy for More Insights

Understanding and leveraging seasonal and cyclical patterns can significantly enhance your trading performance. At FXC Academy, we provide comprehensive training and resources to help you master these techniques and more. Join us to gain deeper insights and elevate your trading strategy. We provide an in-depth analysis of seasonal patterns for Gold, Pound and USD.

Explore our courses and join the community of informed and strategic traders.

What seasonal or cyclical patterns have you noticed in your trading experience?

Maintaining Emotional Discipline in Trading

In the world of trading, emotional discipline is as crucial as technical knowledge. Market volatility can trigger emotional responses that lead to impulsive decisions and significant financial losses. Maintaining emotional discipline helps traders stay focused, make rational decisions, and enhance their long-term success. Let’s explore the importance of emotional discipline in trading and techniques to remain calm and focused during volatile market conditions.

The Importance of Emotional Discipline

Rational Decision-Making:

Emotional discipline ensures that trading decisions are based on logic and strategy rather than fear, greed, or panic. Rational decision-making is vital for consistent and profitable trading outcomes.

Risk Management:

Emotions can cloud judgment, leading to poor risk management practices such as over-leveraging or failing to use stop-loss orders. Emotional discipline helps traders adhere to their risk management rules, protecting their capital.

Consistency:

Successful trading relies on consistent execution of a well-defined strategy. Emotional discipline prevents deviation from the strategy due to temporary emotional states, ensuring consistent performance over time.

Techniques to Stay Calm and Focused

Develop a Trading Plan:

A comprehensive trading plan includes entry and exit points, risk management rules, and clear strategies. Having a plan reduces uncertainty and provides a structured approach to trading, minimizing emotional reactions.

Practice Mindfulness and Meditation:

Mindfulness and meditation techniques help traders stay present and focused. Regular practice can enhance emotional regulation, reduce stress, and improve overall mental clarity during trading sessions.

Use Stop-Loss Orders:

Implementing stop-loss orders ensures that losses are controlled and prevents the emotional turmoil of watching a trade move significantly against you. This automated approach helps maintain discipline and protect capital. Otherwise the emotion of hope and the hope that the trade might reverse will negatively affect your trading decisions.

Set Realistic Goals:

Setting achievable trading goals keeps expectations in check and prevents emotional highs and lows. Realistic goals help traders stay focused on long-term success rather than short-term gains.

Conclusion

Emotional discipline is a cornerstone of successful trading. By maintaining calm and focus, traders can make rational decisions, manage risk effectively, and achieve consistent results. Implementing techniques such as developing a trading plan, practicing mindfulness, using stop-loss orders, and setting realistic goals can significantly enhance emotional discipline. In the dynamic and often unpredictable world of trading, staying emotionally disciplined is key to long-term success.

How do you maintain emotional discipline in your trading practice? Share your techniques and experiences in the comments below!

Is Backtesting a Helpful Tool for Traders?

Ever wondered if trading in a live market is as smooth as backtesting? With no emotions clouding judgment, backtesting offers a clear lens into strategy performance. But is it truly a reliable predictor of future success? Let’s delve into the merits and limitations of backtesting to determine its efficacy.

What is Backtesting?

Backtesting involves applying a trading strategy to historical market data to evaluate its effectiveness. By simulating trades based on past data, traders can assess how a strategy would have performed, providing insights into its potential success in live markets.

The Benefits of Backtesting

Performance Evaluation:

Backtesting allows traders to see how a strategy would have performed historically. This can help in identifying strengths and weaknesses, refining the strategy before real capital is at risk.

Objective Analysis:

By using historical data, backtesting removes emotional biases from the equation. Traders can objectively evaluate a strategy’s performance based on data rather than subjective judgment.

Risk Management:

Through backtesting, traders can identify the risk parameters of a strategy. This includes understanding drawdowns, the worst-case scenarios, and the overall risk-to-reward profile.

Optimization:

Backtesting enables traders to optimize their strategies. By tweaking various parameters and testing their effects, traders can improve the performance of their strategies before implementation.

Confidence Building:

Successful backtesting results can build a trader’s confidence in their strategy. Knowing that a strategy has performed well historically can provide reassurance when deploying it in live markets.

The Cons of Backtesting

Historical Bias:

Backtesting relies on historical data, which may not accurately reflect future market conditions. Markets evolve, and strategies that worked in the past may not be effective in the future. The strategy is too closely tailored to historical data, making it less likely to perform well in future, unseen market conditions.

Lack of Emotional Pressure:

Backtesting does not account for the psychological pressure of live trading. Emotions such as fear and greed, which can significantly impact decision-making, are absent in a backtest scenario.

Data Quality and Integrity:

The accuracy of backtesting results heavily depends on the quality and integrity of historical data. Inaccurate or incomplete data can lead to misleading conclusions about a strategy’s effectiveness.

Transaction Costs and Slippage:

Backtesting often overlooks real-world factors like transaction costs and slippage, which can significantly impact profitability. These elements need to be factored in to get a realistic picture of a strategy’s potential.

Is Backtesting Helpful?

Backtesting is a valuable tool for traders, providing a structured approach to evaluating and refining trading strategies. It offers a glimpse into how a strategy might perform and helps in optimizing and managing risk. However, it is not without limitations. Traders must be cautious of overfitting, recognize that historical performance does not guarantee future results, and consider real-world trading factors.

Conclusion

Backtesting serves as an essential part of a trader’s toolkit, offering a way to validate and enhance strategies with historical data. While it provides several benefits, traders should be mindful of its limitations and use it in conjunction with other methods, such as forward testing and live market analysis, to ensure a comprehensive approach to strategy development.

What are your thoughts on backtesting? Do you find it an indispensable part of your trading process, or do you rely more on live trading experience? Share your experiences in the comments below!

If you want to backtest with us on the floor join our Gold membership!

Balancing Risk and Reward in Trading: A Critical Examination

Trading is a complex dance of probabilities and outcomes, where every decision can lead to significant gains or losses. Central to this decision-making process is the concept of risk-reward ratio. While some traders swear by the necessity of evaluating risk-reward ratios, others argue that focusing solely on the highest probability trades is the key to success. Let’s delve into both perspectives to understand how they influence trading strategies and outcomes.

Understanding Probabilities in Trading

Probability in trading refers to the likelihood of a trade resulting in a profit. Traders who prioritize high-probability trades focus on setups and strategies that have historically shown a high success rate, often backed by technical analysis, historical data, and market patterns.

Why It Matters

Maximizing Success Rates:

High-probability trades are designed to maximize the likelihood of success. Traders who focus on these setups believe that consistent wins, even if smaller, contribute to long-term profitability.

Simplicity and Clarity:

By honing in on trades with a higher probability of success, traders can streamline their decision-making process, reducing the complexity and stress involved in trading.

Confidence Building

Successfully executing high-probability trades builds trader confidence, which is crucial for maintaining discipline and sticking to the trading plan.

Real-World Application

Consider a forex trader who sets a stop-loss at $50 and a take-profit at $150. The risk-reward ratio here is 1:3. If the trader wins 40% of their trades, over 10 trades, they might lose $50 on six trades ($300) but gain $150 on four trades ($600). The net profit would be $300, demonstrating how a favorable risk-reward ratio can lead to success despite a low win rate.

TP is dynamic and not fixed

An additional perspective to consider is that the size of the stop-loss (SL) is not inherently related to the take-profit (TP) target, which challenges the conventional emphasis on the risk-reward ratio. The primary purpose of a stop-loss is to protect the trade by allowing it enough room to work, accommodating normal market fluctuations, and aligning with strategic levels such as the first area of struggle or a Fibonacci retracement within a healthy trend. This means that the stop-loss should be placed based on technical analysis and the underlying market structure rather than being fixed to achieve a specific risk-reward ratio. Consequently, a fixed reward target might not always be practical or realistic, as market conditions can shift and influence the trade’s outcome. By focusing on strategically placed stop-loss levels, traders can better manage their risk while allowing their trades the necessary flexibility to reach their full potential, rather than being constrained by a predetermined reward expectation. This approach recognizes that the dynamic nature of the market requires adaptability and a more nuanced understanding of risk management.

Real-World Application

Imagine a trader who uses a specific technical setup that has an 80% win rate but offers a modest risk-reward ratio of 1:1. Over 10 trades, they might win eight trades and lose two. With each trade risking $100 for a $100 reward, they would end up with a net profit of $600 ($800 in gains minus $200 in losses).

Understanding Risk-Reward

The risk-reward ratio is a measure that compares the potential risk of a trade to its potential reward. It is calculated by dividing the amount a trader stands to lose if the price moves in the unexpected direction (risk) by the amount of profit they expect to gain if the trade is successful (reward). For instance, a risk-reward ratio of 1:3 implies that for every dollar risked, the trader expects to gain three dollars.

Why It Matters

Mitigating Losses:

By adhering to favorable risk-reward ratios, traders can ensure that their potential losses are minimized relative to their potential gains. This is crucial because even a few successful trades with a high reward can offset multiple small losses.

Consistency:

Over time, consistently trading with a favorable risk-reward ratio can lead to profitability, even if the trader’s win rate is less than 50%. This is because the rewards from winning trades outweigh the losses from losing trades.

Emotional Control:

Trading with a defined risk-reward ratio helps in maintaining emotional discipline. Traders are less likely to make impulsive decisions when they have a clear framework for evaluating trades.

Real-World Application

Consider a forex trader who sets a stop-loss at $50 and a take-profit at $150. The risk-reward ratio here is 1:3. If the trader wins 40% of their trades, over 10 trades, they might lose $50 on six trades ($300) but gain $150 on four trades ($600). The net profit would be $300, demonstrating how a favorable risk-reward ratio can lead to success despite a low win rate.

Balancing Both Approaches

While there are merits to both strategies, the most successful traders often incorporate elements of both. Here’s how you can balance risk-reward ratios with high-probability trades:

Evaluate Both Factors

Before entering a trade, assess both the probability of success and the risk-reward ratio. Aim for trades that offer a high probability of success with a favorable risk-reward ratio.

Adjust Based on Market Conditions:

In volatile markets, focusing on high-probability trades might be more prudent, while in stable conditions, emphasizing risk-reward ratios can help maximize returns.

Win Rate:

A higher win rate demonstrates that a trader can remain profitable even with a negative risk-reward ratio. However, when the win rate is at or below 50%, maintaining a positive risk-reward ratio becomes crucial to mitigate potential losses.

Conclusion

In the intricate world of trading, understanding and applying the concepts of risk-reward ratio and probability of success is crucial for long-term success. Whether you lean towards ensuring a favorable risk-reward ratio or prioritizing high-probability trades, the key is to integrate both perspectives into a cohesive strategy. By doing so, you can make informed, calculated decisions that not only maximize potential gains but also manage potential losses effectively.

The Power of Patience in Trading

How Patience can level up your Trading

In trading, where every tick of the clock can mean gains or losses, patience might seem like a luxury. However, seasoned traders understand that patience is not just a virtue but a crucial skill that can make or break success in the market. In this article, we’ll delve into two aspects of patience in trading: waiting for setups and trusting analysis.

Waiting for Setup

“Being patient is crucial in trading. Sometimes the market has wild movements, followed by slower periods where it settles down. During these calm times, it’s important not to lose the gains from the active weeks before,” emphasizes trader and analyst Dan. His words underscore the importance of resisting the urge to chase quick wins and instead waiting patiently for planned buy/sell opportunities.

One-to-one reviewer Michelle echoes this sentiment, noting that patience proves to be one of the most challenging virtues to cultivate in trading. She highlights how it contradicts our impulsive tendencies driven by the fear of missing out and the allure of quick profits. However, Michelle emphasizes that patience is a skill that can be honed through deliberate practice and experience. By prioritizing long-term objectives over immediate gains, traders can gradually develop the patience required to navigate the complexities of the market with greater composure and strategic foresight.

Founder and head analyst Seb shares his strategy for increasing patience when waiting for setups: “To increase my patience, I worked around my time management first. The best way to not overdo something is to take time away from it. So less time to overthink equals more patience.” Seb’s approach highlights the importance of maintaining balance and not letting trading consume every waking moment, thus avoiding burnout and impulsive decision-making.

Waiting for Take Profit and Trusting Analysis

Traders often face the challenge of patience not only when waiting for setups but also when waiting for their take profit (TP) levels to be reached. It’s tempting to close positions early, fearing a reversal or missing out on potential gains. However, as Seb emphasizes, placing trust in data-driven analysis can alleviate doubt and bolster confidence in sticking to the original plan.

“Trusting analysis is key,” Dan concurs. By relying on thorough analysis and strategic decision-making processes, traders can cultivate patience in holding onto positions until the predetermined TP levels are reached. This professional ethos ensures disciplined adherence to trading strategies, even in the face of market fluctuations and emotional impulses.

The Rewards of Patience

While patience may not always bring immediate gratification, its rewards are undeniable. By patiently waiting for high-probability setups and trusting in thorough analysis, traders can avoid reckless decisions driven by fear or greed. This disciplined approach not only minimizes losses during choppy market conditions but also maximizes gains during favorable trends.

In conclusion, patience is indeed a powerful asset in trading. Whether it’s waiting for setups to materialize or holding onto positions until TP levels are reached, patience allows traders to approach the market with composure, discipline, and strategic foresight. By resisting impulsive tendencies, prioritizing long-term objectives, and trusting in data-driven analysis, traders can significantly improve their chances of long-term success in the dynamic world of trading. As the saying goes, patience truly pays off.

Mastering Trading Psychology: Overcoming Execution Issues

Welcome to the FXC Academy trading floor, where we delve into the intricacies of trading psychology and tackle execution issues head-on. Join us behind the scenes as we navigate through the challenges and empower traders to conquer their psychological hurdles.

Identifying Execution Issues

On the trading floor, our team has identified a recurring issue among new traders concerning execution. In Tier 2 of our proprietary trading journal, we meticulously track execution rates to understand why trades are not being executed. Is there a logical reason behind it, or is it driven by emotional factors such as fear?

Developing a Strategic Approach

In Tier 2, we focus on developing a trading plan that implements strict rules to mitigate emotional impacts on our trading decisions. By setting clear guidelines and parameters, traders can execute their trades with confidence and discipline. This structured approach helps reduce hesitation and second-guessing, leading to more consistent and profitable trading outcomes.

Monthly Assessments and Coaching

We reassess execution rates during our monthly one-on-one coaching sessions to monitor progress and provide personalized guidance. By analyzing execution data and discussing trading experiences, we empower our traders to make informed decisions and trust their analysis. Through continuous support and feedback, traders gain the confidence to execute their trades with conviction.

Empowering Traders for Success

At FXC Academy, we empower our traders to execute with confidence by instilling trust in their analysis and trading abilities. By prioritizing execution and adhering to strategic guidelines, traders can increase their win rate and achieve greater consistency in their trading results. Ultimately, mastering trading psychology is key to overcoming execution issues and thriving in the competitive world of trading.

The Trading Journey: From Beginner's Luck to Consistent Profits

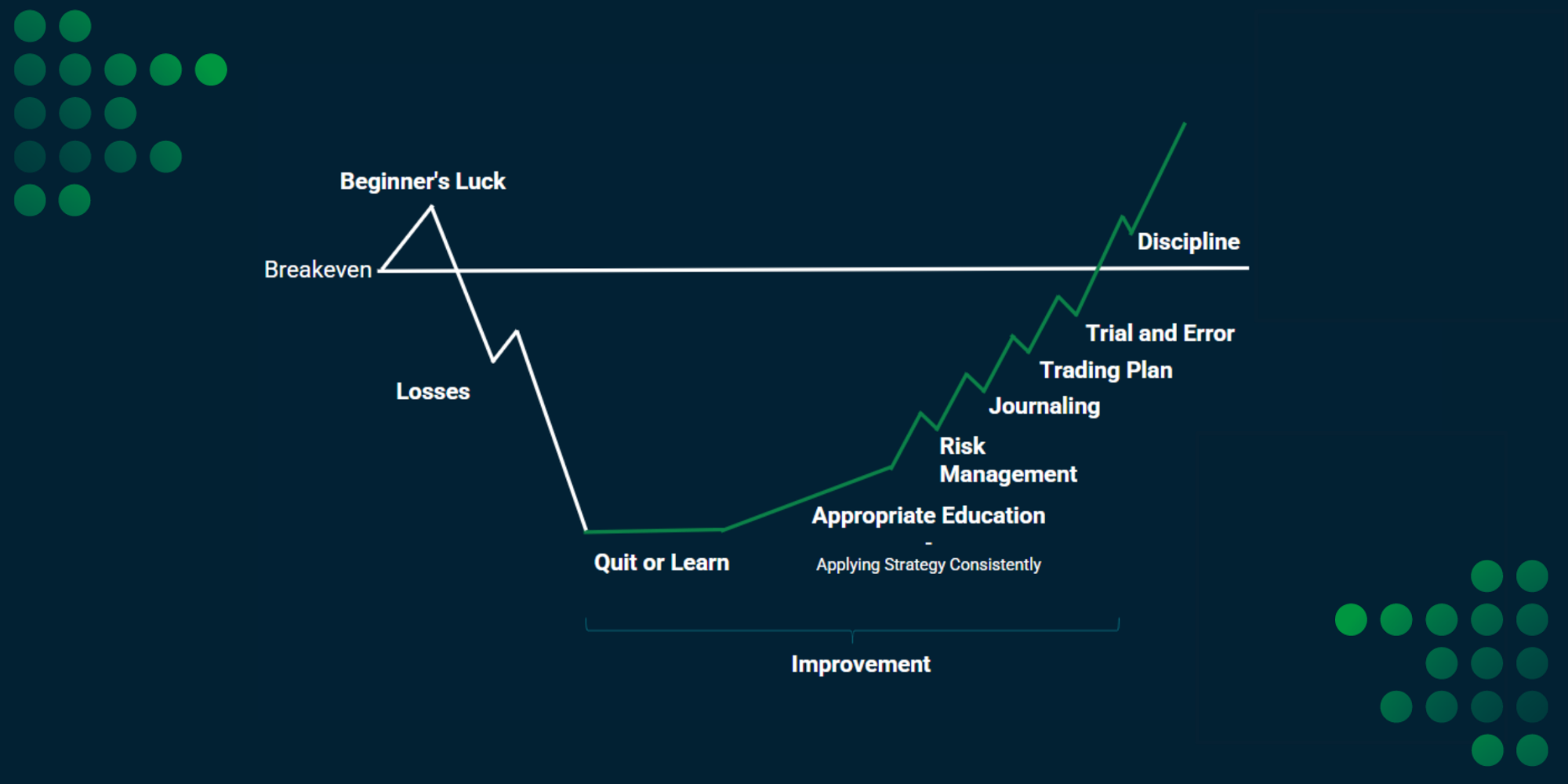

Embarking on a trading journey is akin to stepping into a world of uncertainty, opportunity, and challenge. It’s a path marked by highs and lows, victories and defeats, but ultimately, it’s a journey of growth and mastery. Let’s explore the stages of this journey, from the initial thrill of beginner’s luck to the disciplined consistency required for sustainable success.

Beginner's Luck: The Exciting Start

For many, the journey begins with a rush of excitement fuelled by beginner’s luck. The markets seem to respond favourably to initial trades, reinforcing a sense of confidence and invincibility. However, this euphoria can be misleading.

Reality Check: Overconfidence and Losses

The initial success often breeds overconfidence, leading to risky decisions fuelled more by emotion than sound strategy. Without sufficient experience, losses inevitably follow, serving as a harsh wake-up call.

Crossroads: Quit or Learn?

For many, the journey begins with a rush of excitement fuelled by beginner’s luck. The markets seem to respond favourably to initial trades, reinforcing a sense of confidence and invincibility. However, this euphoria can be misleading.

Beginner's Luck: The Exciting Start

Faced with adversity, traders reach a critical decision point: give up or commit to learning and improvement. Those who choose the latter set the stage for genuine progress.

Pursuit of Knowledge: Investing in Education

To navigate the complexities of the market, traders must invest in education. Learning how to apply a strategy consistently, especially over the long term, becomes paramount. This marks the beginning of a more deliberate and informed approach.

Embracing Risk Management

Armed with knowledge, traders learn the importance of risk management. Preserving capital becomes a priority, mitigating the impact of inevitable setbacks and losses.

The Power of Journaling

Keeping a trading journal emerges as a transformative practice. Documenting trades, analysing decisions, and reflecting on outcomes provide invaluable insights for improvement

Crafting a Trading Plan: Data over Emotion

Keeping a trading journal emerges as a transformative practice. Documenting trades, analysing decisions, and reflecting on outcomes provide invaluable insights for improvement

The Power of Journaling

With a focus on data-driven decision-making, traders establish robust trading plans. Emotions are set aside in favour of rationality, ensuring consistency and clarity in execution.

Trial and Error: Refining Strategies

Through a process of trial and error, traders refine their approach, identifying what works and what doesn’t. Each setback becomes an opportunity for learning and adaptation.

Discipline: The Key to Consistency

At the heart of success lies discipline. Staying true to the principles of risk management, journaling, and a well-defined trading plan, traders cultivate the consistency needed for long-term profitability.

Conclusion: The Journey of Improvement

The trading journey is a dynamic evolution, marked by growth, setbacks, and ultimately, mastery. From the initial allure of beginner’s luck to the disciplined consistency of seasoned professionals, every step is a lesson in resilience and adaptation. Through education, risk management, and unwavering discipline, traders transcend the pitfalls of overconfidence and emotion, emerging as proficient navigators of the financial markets. So, embrace the journey, for it is not merely a path to profits but a voyage of self-discovery and continual improvement.

FXC Academy: Your Partner for Success

At FXC Academy, we understand the challenges and complexities of the trading journey firsthand. That’s why we’re honoured to be a part of your journey, offering guidance, support, and expertise every step of the way. Our team is dedicated to providing comprehensive education, personalized mentorship, and a supportive community to help you achieve your trading goals. With our wealth of experience and commitment to excellence, we stand ready to empower you with the knowledge and tools needed to navigate the markets confidently and successfully. Together, let’s turn your trading aspirations into reality with FXC Academy by your side. Convince yourself and join our free Discord!

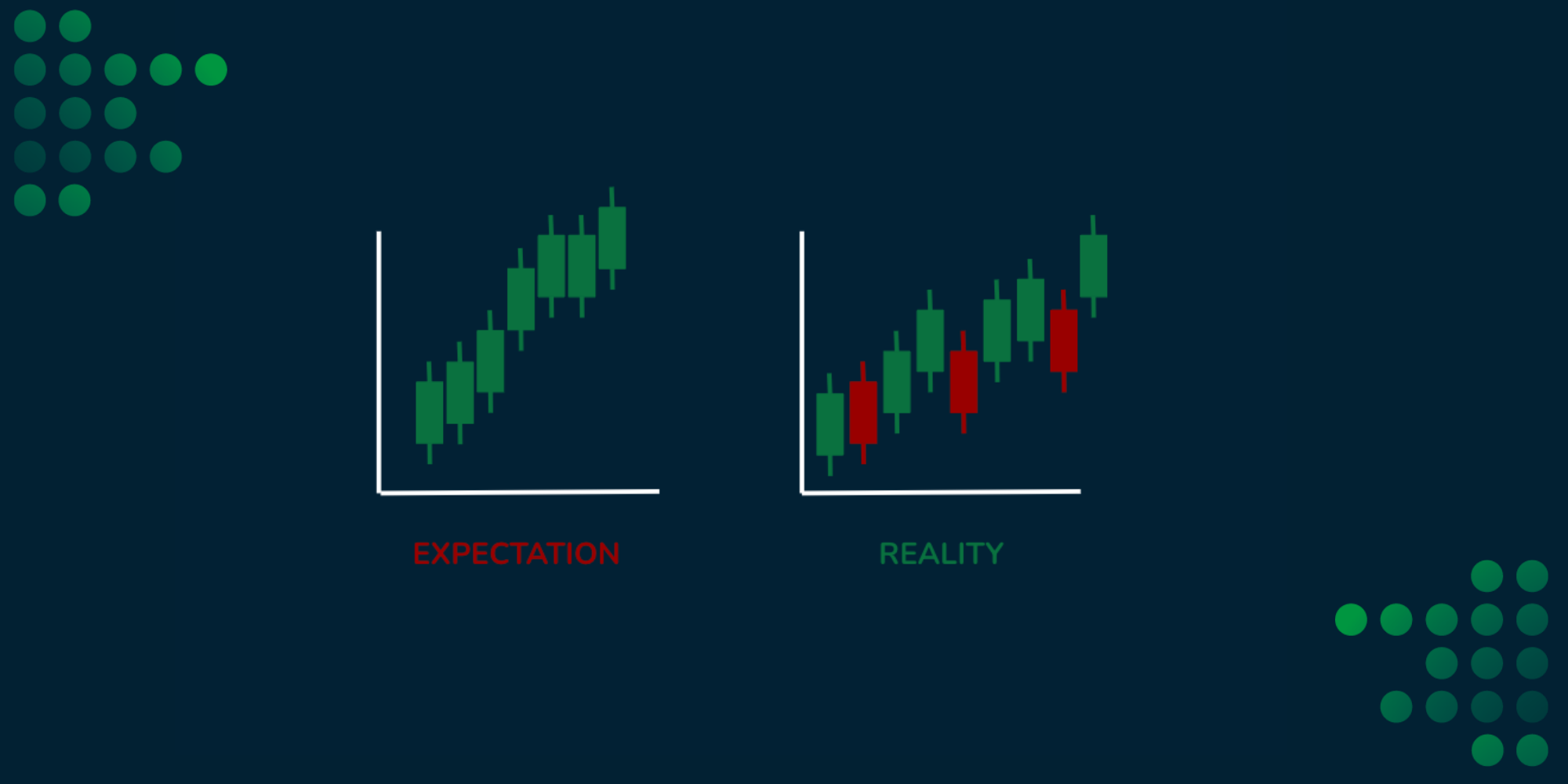

Managing Expectations in Forex Trading

Embarking on a trading journey is similar to setting sail into a sea of opportunity and challenge. However, amidst the excitement and potential for profit, it’s crucial to anchor oneself in reality by managing expectations effectively. Let’s explore the key principles of expectation management in trading and how they can shape your path to success.

Setting Realistic Goals: The Foundation of Success

The importance of setting realistic goals cannot be overstated. While ambition is admirable, setting overly ambitious or unrealistic targets can lead to disappointment, frustration, and even reckless decision-making. When setting goals, consider factors such as your experience level, risk tolerance, and market conditions. The risk of not setting expectations right is not just financial; it’s psychological, undermining the trader’s ability to navigate the challenges of the market with resilience and composure. Aim for objectives that stretch your capabilities without setting you up for failure. Understanding the importance of setting realistic goals is the first step.

Short and Long Term Goals: Balancing the Horizon

Distinguish between short-term and long-term goals to provide clarity and direction to your trading journey. Short-term goals might include achieving a certain percentage return on investment within a month, while long-term goals could involve building a sustainable trading portfolio over the course of a year. For example, a short-term goal could be to consistently earn 1% profit per week, while a long-term goal might be to achieve an annualized return of 20%.

Regularly Reviewing and Adjusting Goals: Flexibility is Key

Goals are not set in stone. Regularly review and adjust your objectives based on changing market conditions, personal circumstances, and evolving aspirations. Establishing a routine for goal assessment and adjustment demonstrates discipline and adaptability, essential traits for success in trading.

Guidance from Experienced Traders

Seek guidance from experienced traders who have navigated the ups and downs of the market. At FCX Academy, our community of traders offers a wealth of knowledge, insights, and support to help you refine your approach and stay on track towards your goals. Learning from the experiences of others can provide valuable perspective and help you avoid common pitfalls. In our gold membership we help our traders to set goals in our one-to-one review.

Embracing Incremental Progress: Small Steps, Big Gains

In trading, as in life, progress often comes in increments. Celebrate small victories and recognize the power of consistent effort over time. Remember, trading is a marathon, not a sprint. Be patient with yourself and trust in the process of continuous improvement.

Understanding the Journey: Time and Patience

Just as mastery in any profession requires time and dedication, so too does success in trading. Embrace the journey with a mindset of patience and perseverance. Every setback is an opportunity to learn and grow, bringing you closer to your goals.

In conclusion, managing expectations in trading is a balancing act that requires foresight, flexibility, and resilience. By setting realistic goals, balancing short and long-term objectives, seeking guidance from experienced traders, and embracing incremental progress, you can chart a course towards sustainable success in the dynamic world of trading.