Mastering Emotions for Consistent Wins

When most traders think about becoming profitable, they focus on strategy, indicators, or finding the “perfect setup.” But the truth is this: your mindset determines your long-term success more than any strategy ever will. In Forex trading, psychology isn’t optional, it is the core foundation of consistent performance.

In this blog, we’ll explore why understanding your emotions, wiring new mental habits, and thinking in probabilities can elevate your trading instantly.

Why Trading Psychology Matters More Than Strategy

Every trader has experienced fear, greed, hesitation, or revenge trading. You know the strategy. You know the chart. Yet something internal pulls you off track.

That “something” is your brain’s neurochemical response to uncertainty, risk, and reward.

When dopamine spikes after a win, you may try to chase the next setup.

When cortisol rises during a losing streak, you may freeze or exit too early.

The key to mastery is rewiring your brain, building new associations with risk, and learning to interpret emotional signals instead of reacting blindly to them.

Emotional Discipline = Consistent Results

Successful traders aren’t emotionless—they are emotionally controlled. They understand:

-

Fear often masks overexposure or lack of confidence in the plan

-

Greed comes from unrealistic expectations

-

FOMO occurs when you don’t trust your own process

-

Revenge trading is a chemical reaction, not a rational decision

When you build emotional awareness, you replace impulsive behavior with probability-based thinking.

Thinking in Probabilities: The Trader’s Secret Weapon

The market is never certain, only probabilistic. This is why elite traders operate like statisticians, not gamblers.

When you think in probabilities:

-

Each trade becomes just one of many outcomes

-

Losses are expected events, not emotional shocks

-

You stop trying to be right and focus on doing the right thing

This shift alone rewires your brain for long-term stability and confidence.

Using Checklists to Replace Emotion With Structure

Trading checklists are powerful psychological tools that:

-

Anchor your decisions

-

Reduce mental noise

-

Prevent emotional trades

-

Ensure consistency under pressure

A detailed checklist helps your brain stay aligned with logic, not emotion. It acts as a decision-making framework that trains discipline over time.

Join Our Psychological Trading Webinar

To truly master your psychology, you need guided training, not just theory.

That’s why we currently host a specialized Forex psychology webinar, available exclusively for Silver and Gold Members.

In these weekly live sessions (and recordings available in the library), we dive deeply into:

1. General Trading Psychology

Understand how your brain reacts during uncertainty and how to override subconscious patterns.

2. Dissolving Trading Fears

Learn structured methods to reduce hesitation, overthinking, and emotional blocks.

3. Thinking in Probabilities

Develop the mental framework elite traders use to make objective decisions.

All sessions are based on neuroscience, explaining the neurochemical reactions behind trading emotions and how to create new, profitable mental associations.

Take Your Trading Mindset to the Next Level

If you’re ready to transform your mindset, upgrade your discipline, and break emotional trading habits, join now and attend the webinar live, or watch it later inside your member library.

How to Overcome Procrastination

Reclaim Your Focus

Procrastination isn’t just about laziness, it’s often a symptom of uncertainty, fear, and lack of direction. The good news? You can replace it with clarity, discipline, and daily momentum. Here’s how to build habits that keep you moving forward every single day.

1. Build Daily Routines — Structure Creates Freedom

Strict plans don’t limit your creativity, they give it direction. Uncertainty creates emptiness, and that emptiness is often filled with procrastination. By setting clear daily routines, you eliminate decision fatigue and create mental space for progress.

Start small: plan your mornings, define work blocks, and commit to a simple “non-negotiable” list for the day. Over time, routine turns discipline into second nature, and your dreams start to become your daily reality.

2. Choose the Right Surroundings — Your Environment Shapes You

Your environment silently determines your trajectory. Surround yourself with people who lift you up, challenge you to grow, and share your vision. Positive, driven individuals help you stay focused and motivated when distractions or self-doubt creep in.

Look at your surroundings and ask yourself: is this environment pushing me toward progress or keeping me stagnant? The right energy around you can transform your mindset and your output.

3. Focus on the Journey — Small Steps Beat Big Leaps

Big goals can feel overwhelming when you only focus on the finish line. That pressure often leads to paralysis and procrastination. Instead, zoom in on the next actionable step, the one small move you can make today.

By focusing on the process rather than perfection, you build momentum. Every completed task, no matter how small, brings you closer to your ultimate goal—step by step.

4. Celebrate Daily Progress — The Power of 1% Improvement

As James Clear explains in Atomic Habits, small, consistent progress compounds over time. Improving just 1% each day might seem insignificant, but over weeks and months, it becomes transformative.

Track your progress, celebrate small wins, and acknowledge your effort. This daily recognition builds confidence and reinforces your routines, protecting you from falling back into procrastination.

Procrastination loses its power when you have structure, clarity, and a clear path to follow. Success — whether in trading or personal growth — doesn’t come from rushing, but from consistent, guided progress.

That’s exactly why, in our Gold Membership, we provide you with a step-by-step trading roadmap that outlines your entire journey, from onboarding to independence. Just like the FXC Trading Roadmap, you’ll always know what comes next, what to focus on, and how your growth unfolds.

When you can clearly see your next step, procrastination has no room to exist. Every tier, every call, every milestone keeps you moving forward, with purpose, confidence, and consistency.

Is Trading Right for You? 4 Questions to ask yourself

The first contact many people have with trading often comes through signal groups, flashy mentors, or overpriced coaching programs. Behind this is a simple desire: to make money quickly and easily from home. For many, however, this leads to disappointment and disillusionment.

Trading is a journey, not a shortcut. It’s more like learning a musical instrument or building strength through training, it requires consistent practice, patience, and dedication. So, the question arises: Is trading the right path for you?

The Important Questions

Contrary to critics, it is possible to make money with trading, but success is rare, much like excelling in guitar, football, or any specialized skill. Trading is both an art and a science, and it demands personal commitment. Ask yourself:

-

Are you motivated and capable of studying charts over the long term?

-

Can you confront your emotions and be honest with yourself?

-

Are you free from financial pressure to achieve instant success?

-

Are you willing to maintain detailed documentation and track your progress?

The 4 Core Elements of Trading

If your answer is “yes” to all of the above, focus on developing the four core elements of trading:

-

Consistent work – Daily effort and disciplined practice.

-

Honest self-reflection – Understanding your mistakes and emotional triggers.

-

Patient growth – Accepting that success comes gradually.

-

Continuous development – Never stop learning and adapting.

Notice that strategies and tactics come later. Trading is much like traditional martial arts, a path of personal development, discipline, and self-awareness.

Trading as a Journey

Trading can be financially rewarding, and it has brought me personal financial success. But the foundation of this success wasn’t chasing quick riches, it was built on the four elements above. The focus was on “getting better,” not “getting rich.”

To make your trading journey smoother and help you achieve quicker milestones, we’ve designed our Gold Membership with a 3-tier system. Each tier builds on the last, gradually increasing in complexity as you level up your skills and confidence. This structure allows you to progress at your own pace while mastering the core elements of trading.

Read more about our Gold Membership here.

Sense within yourself whether you’re ready to engage with trading and charts over the long term. Daily practice, self-reflection, and continuous growth are the keys to long-term success.

Enjoy the journey of self-exploration, it’s where the real rewards of trading lie.

If you’re still unsure whether trading is right for you or how we can support your journey, simply book a free call. During the call, we’ll explore your goals, see if they align with our approach, and determine how we can help you grow as a trader.

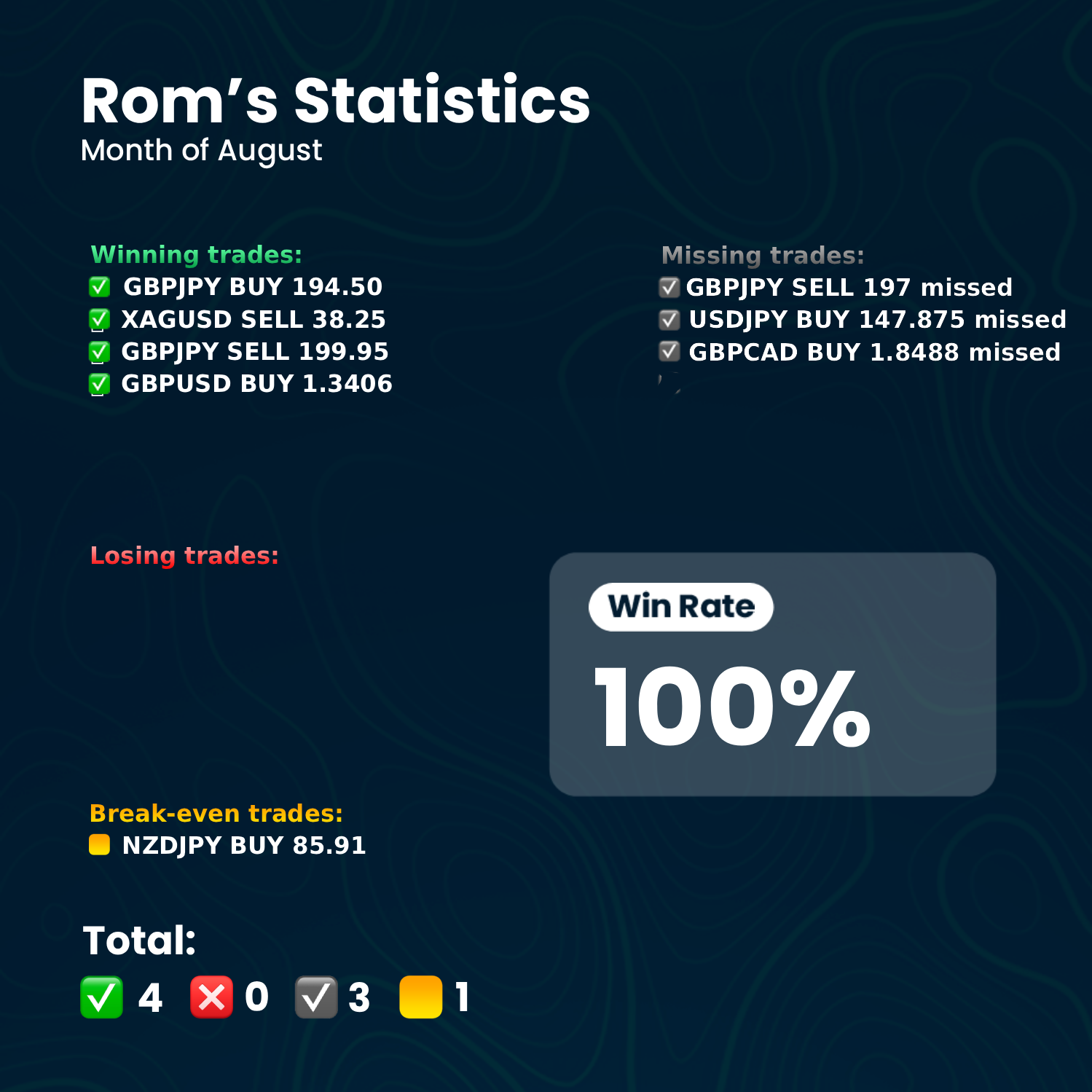

100% Win Rate in August – Rom Shows How It’s Done!

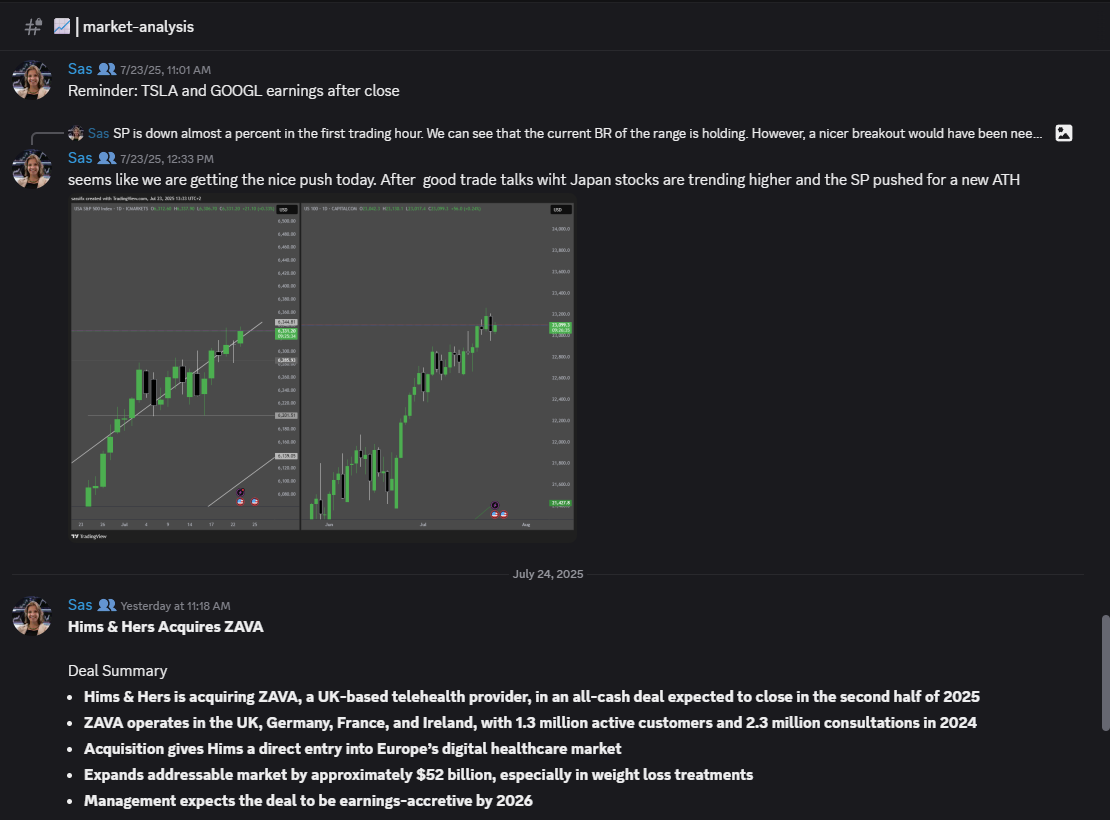

August is often called a “dead month” in trading. Low volatility, summer holidays, and unpredictable swings make many traders step aside. But not Rom, one of FXC’s top analysts. Instead of sitting out, he delivered a perfect month: 100% win rate, no losses, and complete transparency.

Every Trade Called Live – Zero Guesswork

Rom doesn’t just post charts after the fact—every trade was called beforehand and live-managed with the community. Silver Members had front-row seats to flawless execution, seeing strategy in real time.

August Results Recap

Missed trades: 3 (by less than 5 pips—purely summer volatility issues)

That’s what consistency looks like. Even the “missed” calls ended up delivering; Rom just chose tighter entries to minimize drawdown.

Why Strategy > Seasonality

While others avoided August, Rom proved it’s not the month—it’s the strategy. With discipline, patience, and precision, even a “slow” market becomes an opportunity.

“Less is more. Always. Quality over quantity or you’ll end up making 0.” – Rom

What’s Next?

September is here, and Rom is already preparing charts for the next big moves. If setups align, he’ll strike. If not, he’ll wait—because that’s how consistency is built.

Ready to stop sitting on the sidelines and start banking with FXC?

Your next win could be one trade away.

Join Gold Membership today and get coached by Dan, Sas, or Rom directly. Learn the same strategies behind Rom’s flawless August and level up your trading.

How can we help you?

Book your free call to find out how we can help you best to elevate your trading.

Investor Lounge Launch: Free Access to Long-Term Trading Insights

FXC is excited to announce the launch of The Investor Lounge, a new premium section in our Discord community designed exclusively for long-term investors and wealth builders. Launching August 1st, the Investor Lounge will be available free to all members for the entire month of August.

Whether you’re just starting your investment journey or you’re a seasoned trader looking to grow long-term wealth, the Investor Lounge is your new go-to space for strategic education, actionable analysis, and meaningful discussions.

What Is the Investor Lounge?

Inside the Investor Lounge you will find:

-

In-depth market analysis and forward-looking stock ideas

-

Daily discussions with like-minded investors

-

Knowledge resources to support your financial education and independence

-

Regular updates on market trends, sector movements, and innovative financial strategies

-

Detailed stock charts and long-term investment themes

- Weekly Livestream

At FXC, we believe that trading isn’t just about short-term gains. It’s about leveraging those profits to create sustainable financial growth. While day trading can generate income, long-term investing puts your capital to work, helping you build wealth over time. Profit isn’t the finish line—it’s the starting point for a smarter financial future.

Free Access Throughout August

To celebrate the launch, the Investor Lounge will be open to all Discord members, completely free, throughout the month of August. This is the perfect opportunity to experience the value of long-term investment insights and community interaction without any commitment.

Watch Our First Livestream

To kick off the Investor Lounge, we hosted a free livestream discussing one of the most common financial thinking errors that holds traders back from building lasting wealth. In this session, we explored how short-term habits can limit long-term potential and what mindset shifts are necessary to let your money truly work for you over time.

Join the Investor Lounge today to explore everything it offers, completely free for August.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. FXC Academy is not licensed or authorized to provide personalized investment recommendations in any jurisdiction. All readers should conduct their own research and consult a licensed financial adviser before making any financial decisions. Past performance is not a reliable indicator of future results.

10R Week at FXC

June might have started slow here at FXC, but it only took one powerful week in our Silver Membership to demonstrate why proven strategies and disciplined execution consistently outperform guesswork.

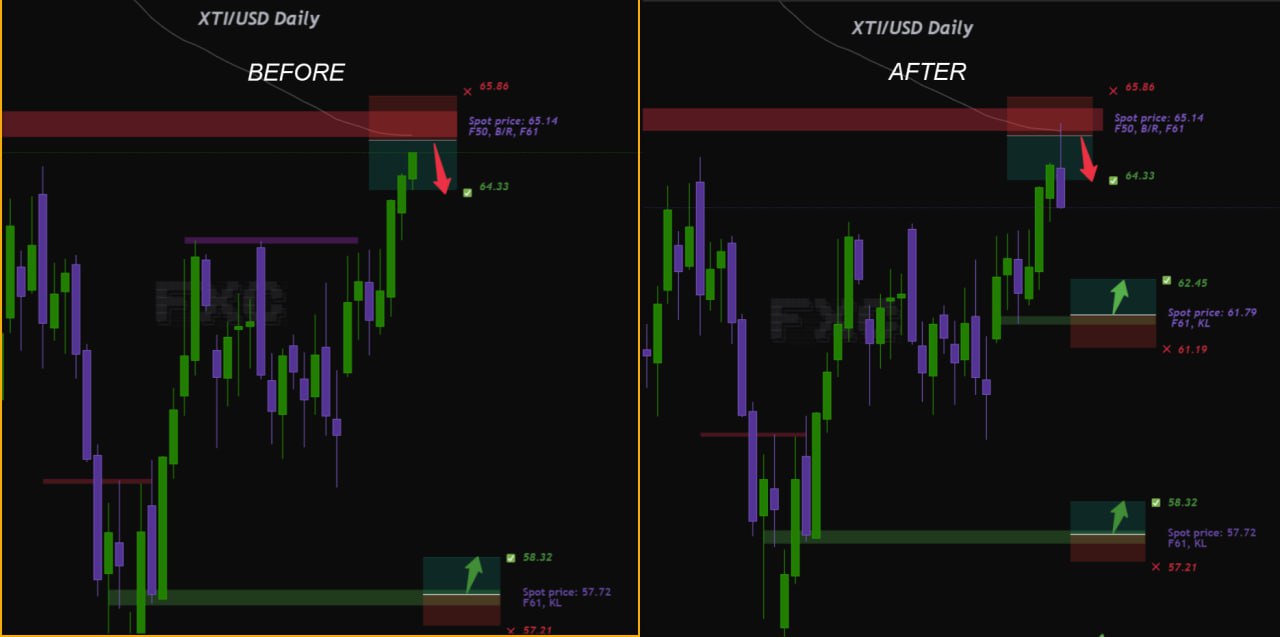

Wednesday: Another Clean Oil Win

Many traders assume FXC is all about forex and gold. The reality is, we cover much more.

Dan, our in-house oil specialist, delivered a precise win on XTIUSD:

-

Main target reached at 64.33

-

Trade management and rationale shared in advance

-

A full video update followed, breaking down the trade and outlining the next setups, available exclusively to Silver and Gold Members

If you have been overlooking commodities, this was the reminder that high-opportunity markets like oil and metals can be an essential part of your trading edge.

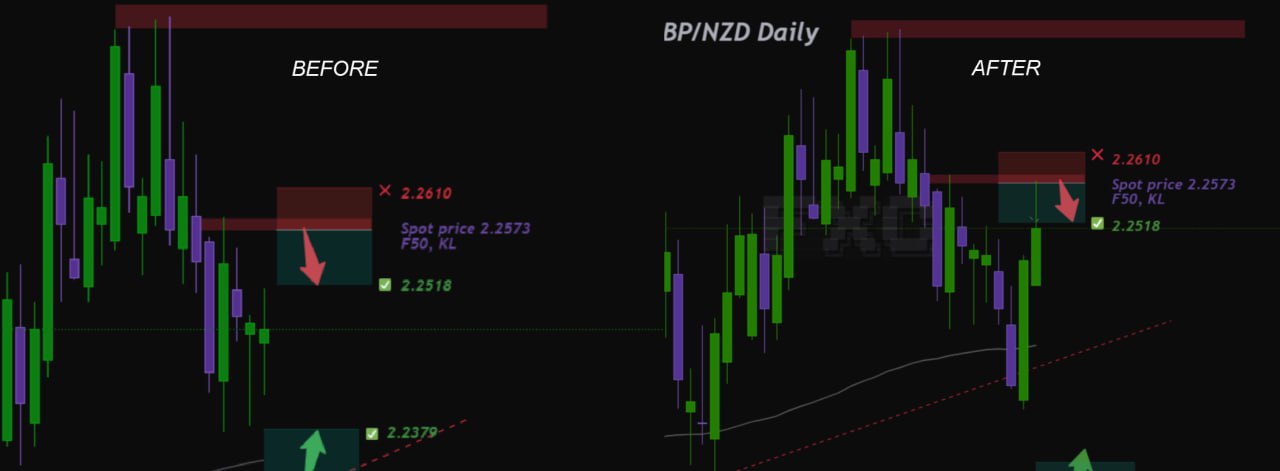

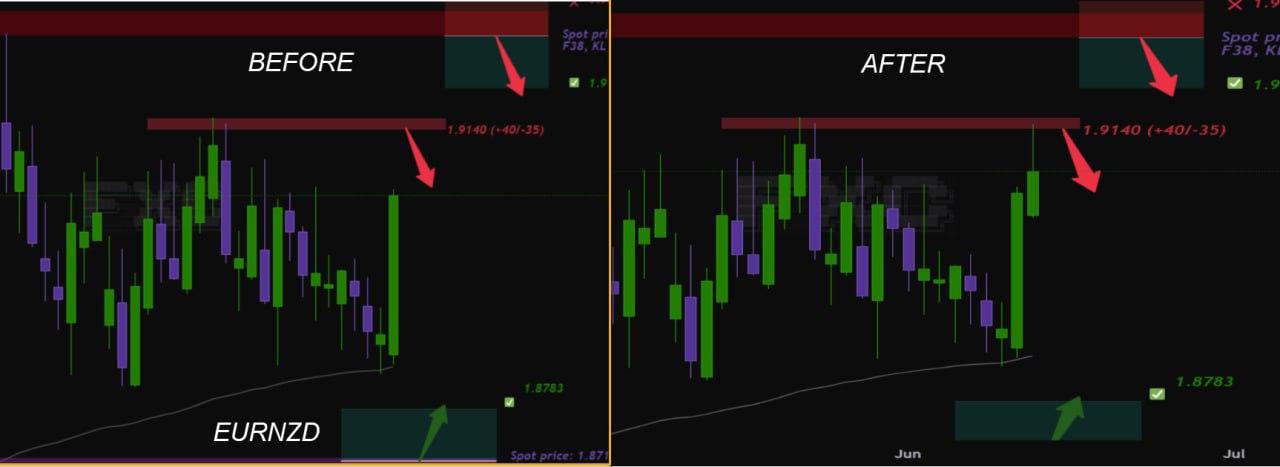

Thursday: 110 Pips Before Breakfast

Thursday morning was a clear example of strategy in action:

-

Members used insights from our Fundamental Course to short GBP after the negative GDP release.

-

Our AI strategy triggered a clean GN sell for Gold Members.

-

Analyst Dan shared an EN sell setup for Silver Members that also reached target.

110 pips secured before most traders had even finished charting their day.

This is not luck. It’s the result of structured analysis, timing, and decisive execution that our members have access to every day.

If you are not part of the Silver Membership, consider this:

-

How many wins have you locked in this week?

-

Are you leaving profits on the table by trading alone?

The truth is simple: This membership can pay for itself – if you put it to work.

Ready to see what consistent trading results look like?

If you’re wondering which membership suits you best, this blog post will guide you through all the options so you can choose the right level of support, tools, and analysis for your goals.

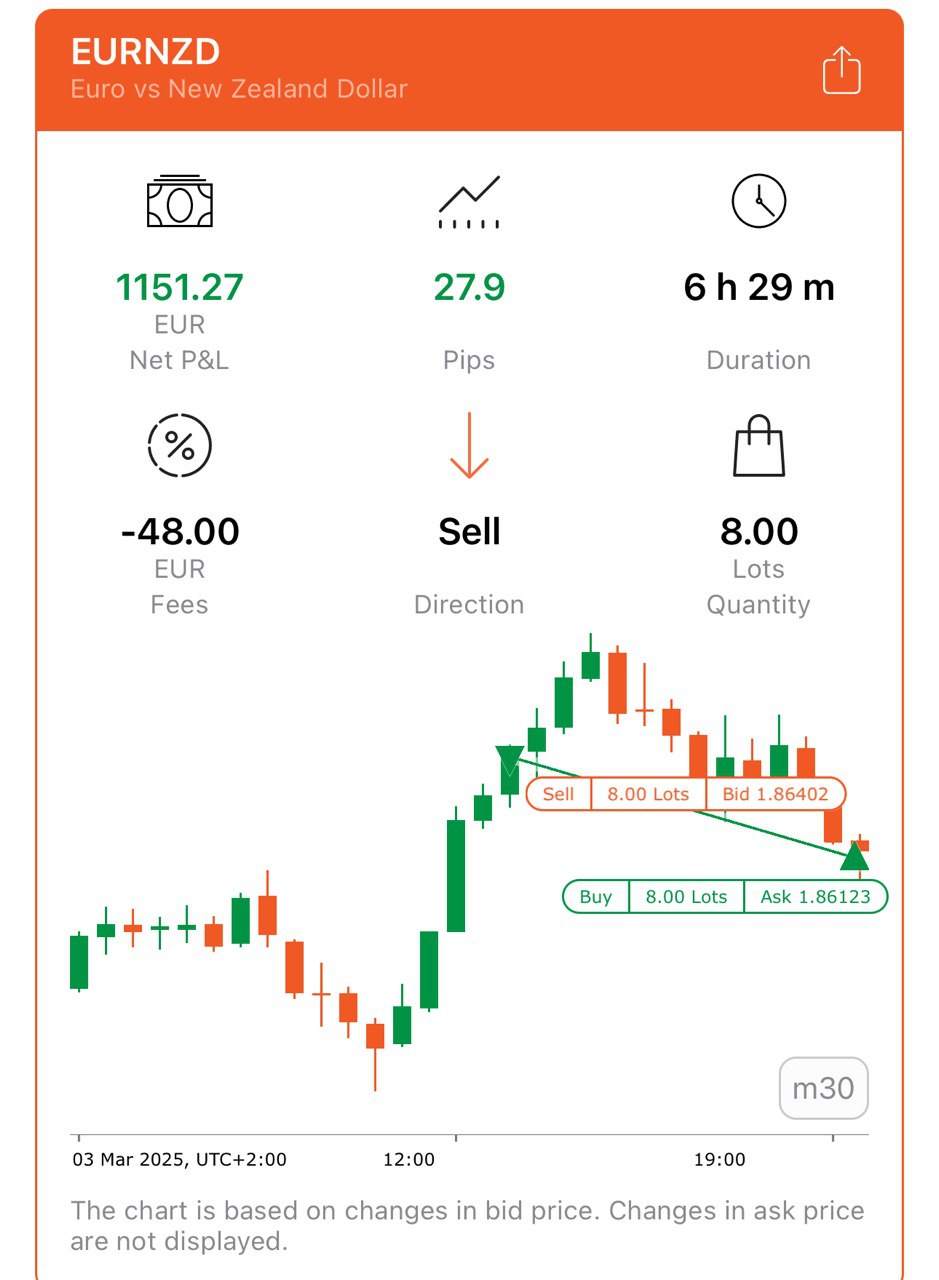

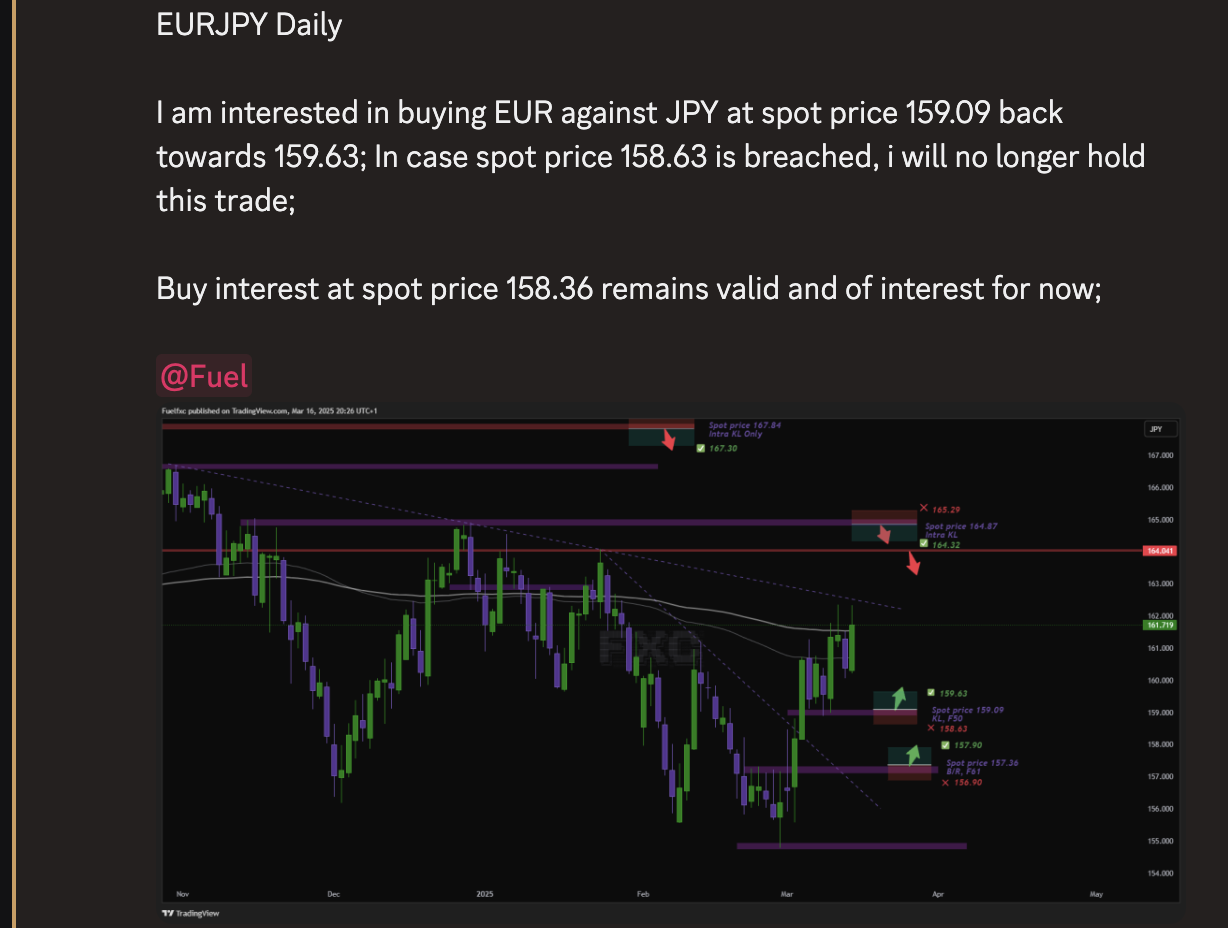

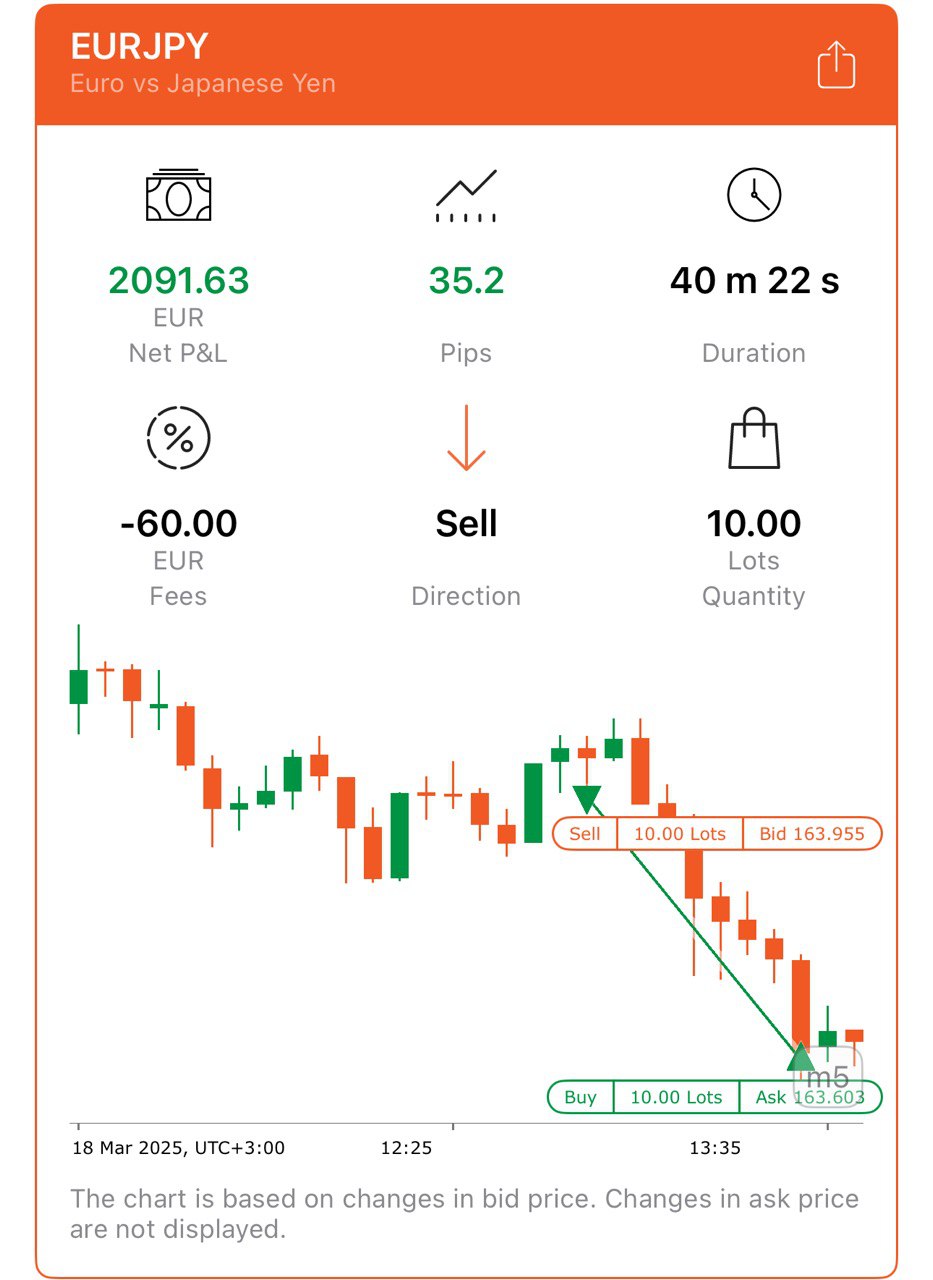

Silver Membership Performance Update

Real-Time Trade Ideas from a Verified Trader

What if you could follow the exact thought process of a consistently verified trader, live?

Inside FXC Academy’s Silver Membership, analyst Dan shares every trade before he takes it. Members see the full setup in real time: entry points, exit zones, and the rationale behind each move, not just a summary after the fact.

Proof Through Performance

Dan recently completed a $200,000 trading challenge using the same strategies he teaches. Every trade, breakdown, and result is transparently documented for educational purposes. His weekly performance summaries show what disciplined execution and consistent risk management can achieve, and it’s all available to members.

From Learner to Leader

This isn’t hindsight or theory – it’s structured analysis shared live with the FXC community. You can learn, ask questions, and grow your trading process alongside a proven system.

Ready to go from student to funded trader – maybe even the next FXC analyst?

The trades are already waiting.

Join Silver Membership and take the first step.

Fundamental Trading Course

On Friday the 28th of March, we hosted a Fundamental Trading Course covering essential economic concepts and fundamental trading strategies. Our goal is to equip our members with the knowledge to optimize their trading decisions beyond just technical trading.

Understanding fundamental analysis is key to making informed trading decisions, avoiding unnecessary risks, and maximizing the longevity of technical trade entries. At FXC Academy, we emphasize a well-rounded approach that combines both technical and fundamental strategies to help traders navigate the financial markets effectively. In this blog post, we’ll cover essential fundamental topics that can significantly impact trading outcomes.

Key Fundamental Topics

Forex Basics & Economic Understanding

We covered the economy’s role in forex. Students learnt how economic cycles, inflation, employment data, and GDP growth influence currency strength. Understanding the bigger picture allows traders to align their strategies with macroeconomic trends.

Trading News Releases

Economic data releases create volatility in the forex market. We teach traders how to interpret these reports, anticipate price reactions, and implement effective strategies for trading high-impact events like CPI, interest rate decisions, and NFP.

Fundamental Biases & Swing Trading

Using our 50Cal strategy, traders learn how to develop a fundamental bias, filter market noise, and align their trades with long-term trends. This approach helps maximize profits while reducing unnecessary trades.

Market Correlations & Currency Characteristics

Understanding how different economies interact and influence currency movements is essential. We explore the correlations between commodities (gold, oil), stock indices, bond yields, and forex markets to refine trade decisions.

Quizzes & Practical Examples

Knowledge alone isn’t enough; applying it is crucial. Our course includes interactive quizzes and hands-on trading exercises that simulate real-world scenarios, helping traders build confidence and refine their skills.

Live In-Person Training on the Trading Floor

Beyond theory, we bring fundamental analysis to life on our trading floor. Members get hands-on experience through live FAQ sessions, example trades, and real-time market analysis. Our interactive quizzes and discussions help reinforce key concepts, ensuring traders can confidently apply their knowledge in live market conditions.

Join our Gold Membership now for expert strategies, analysis, and mentorship!

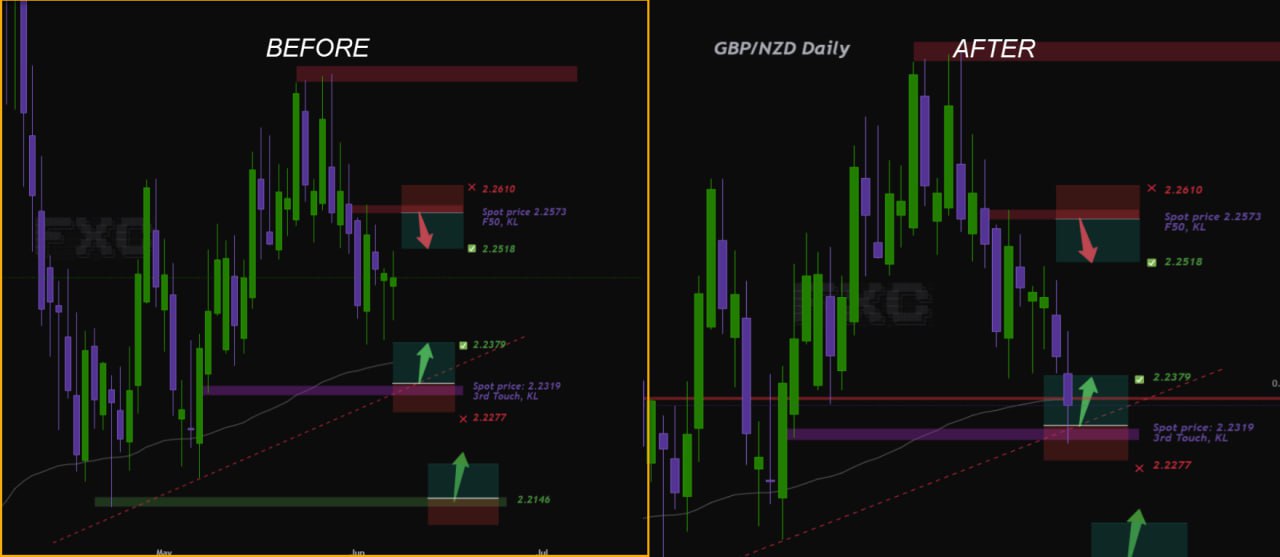

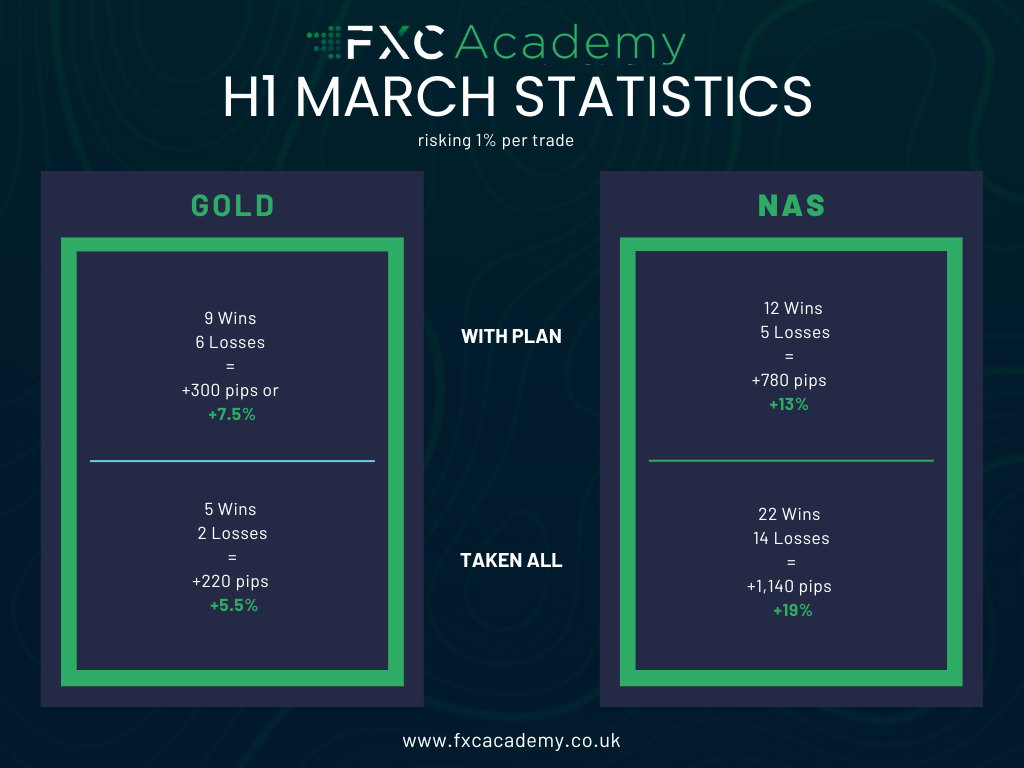

19% Profit in March - Implementing H1 Trading

Developing Our H1 Strategy from a Daily Time Frame Approach

March was a remarkable month at FXC Academy! We successfully implemented H1 trading and are finalizing our trading plan with our Gold Membership members. This transition has allowed us to refine our approach and optimize trade execution in line with current market conditions.

H1 Gold March Stats

Why We Shifted to H1 Trading

The decision to incorporate H1 trading was driven by market conditions, particularly the lower volume on the daily time frame due to uncertainty surrounding Trump’s tariff policies. While the daily time frame remains a powerful tool for identifying overall trends and key levels, the reduced market movement required us to adapt. By shifting to H1, we were able to capitalize on shorter-term movements while still maintaining a strong risk-to-reward ratio.

Building on the Daily Time Frame Approach

Our H1 strategy is not a standalone approach but rather an extension of our daily time frame methodology. We continue to use daily analysis to define the broader market context, such as key support and resistance levels, trend direction, and fundamental influences. However, instead of waiting for daily closures, we use the H1 chart for precision entries and better trade management.

Key aspects of our H1 strategy include:

1:2 Risk-to-Reward Ratio

Ensuring our trades have a favorable 1:2 R:R while keeping losses controlled.

High Win Rate

Maintaining a win rate similar to our daily approach, ensuring consistency in profitability.

Same Charting Approach

Using the same technical analysis principles from the daily time frame to identify high-probability trades.

A Strategy Tailored to Your Lifestyle

One of the greatest advantages of our H1 strategy is its flexibility. We understand that our members have different schedules and trading styles, which is why we provide guidance on how to tailor the strategy to individual lifestyles. Whether you prefer more active trading sessions or a more structured, selective approach, our strategy can be adapted to fit your needs.

With H1 trading, members can:

- Choose the best time slots to trade based on their availability.

- Adapt position sizing and trade frequency to suit their risk appetite.

Finalizing Our Trading Plan

As we continue refining our H1 approach, we are working closely with our Gold Membership members to finalize our trading plan. The goal is to create a well-structured system that combines the strengths of both daily and H1 trading while allowing individual traders to personalize their execution based on their unique preferences.

By bridging the gap between daily and H1 trading, we ensure that our members are equipped with a versatile, effective strategy that adapts to changing market conditions and their personal trading styles.

Click the button below to join our H1 Insights now!

FXC Academy’s January Bootcamp

A Week of Growth, Learning, and Strategy-Building

This January, we successfully concluded our FXC Bootcamp – an exclusive, completely free experience for our Gold and Silver members! It was an incredible week of learning, growth, and strategy-building, giving members the perfect opportunity to establish a strong foundation in trading.

A Bootcamp Designed for Success

The FXC Bootcamp was tailored for beginners and traders looking to refresh their understanding of the fundamentals of our strategy. We ensured that every participant had a firm grasp of the core concepts before advancing to more complex techniques.

Throughout the week, we covered key aspects of the 50cal strategy, providing traders with essential tools to navigate the market confidently. One of the most exciting highlights was having FXC Academy’s CEO, Seb, share insights from his 10+ years of market experience, giving attendees invaluable real-world knowledge and practical strategies.

The Weekly Breakdown:

- Monday: KL + Week Outlook

- Tuesday: Fibs + Trading Psychology

- Wednesday: Trend Lines + Journal Optimization

- Thursday: Drivers & Alignment + Backtesting (extended evening session)

- Friday: Fundamentals Broken Down + Q&A

Beyond the structured lessons, members engaged in interactive quizzes, giveaways, and even some friendly competition in pool and table tennis, fostering a strong sense of community among traders.

Missed the Bootcamp? More Opportunities Await!

For those who couldn’t make it this time, don’t worry – more exciting learning opportunities are on the horizon. Stay tuned for our next bootcamp and upcoming educational events!

We look forward to seeing you in the next session!