2024: A Year of Growth

Gold Membership Launch: A Comprehensive Trading Experience

We started 2024 with the launch of our new Gold Membership, designed to provide a comprehensive and supportive environment for traders of all levels. This premium membership includes full-time access to our trading floor, 1-to-1 mentorship sessions, and access to our revolutionary proprietary trading journal. Of course, it also enables you to learn from our forex and oil analysts and receive insights from Sebastien about fundamentals, metal and indices. These tools have given members the structure and guidance they need to take their trading to the next level.

Throughout the year, we’ve seen many members achieve outstanding progress, moving from Tier 1 to Tier 3 with determination and focus. Tier 3 members now use the most advanced journaling tools to collect data, analyze performance, and refine their strategies for maximum results. By addressing weaknesses during tailored 1-to-1 reviews and building a solid trading plan, we were able to achieve incredible growth with our members. Below you can find feedback of one of our members. His story exemplifies what is possible with hard work, dedication, and the right support system.

AI Signals: Smarter Tools for Smarter Trading

In the summer, we introduced an exciting development: our alert system. This advanced tool is designed to give traders a competitive edge by providing real-time notifications for trade setups and management updates. The system helps members make informed decisions faster and with greater precision. By simplifying the decision-making process, the system allows our traders to focus on execution while staying alert to potential opportunities and risks. This innovation has been a game-changer for our community, and we are excited to continue refining it in the year ahead.

Transition to Discord: A Vibrant and Engaged Community

October marked a significant shift for FXC as we transitioned from Telegram to Discord to create a more interactive and dynamic community space. Discord has enabled us to provide a more robust and engaging experience for our members. Some of the new features we’ve introduced include:

PnL channel

A channel, where members can share their results and progress transparently, inspiring each other to stay motivated.

Educational Section

A new Educational Section, designed to provide members with all the resources they need to review and master the foundational strategies we teach.

Weekly live breakdowns

Weekly live breakdowns for Silver and Gold members, giving them valuable insights into market conditions and helping them prepare for the week ahead.

Livestreams with Head Trader and CEO Seb

Exclusive Livestreams with Head Trader and CEO Seb for Gold members, offering advanced guidance and direct interaction with our leadership team.

This transition has strengthened our sense of community and provided members with new ways to learn, connect, and grow together.

Bronze Membership: Making Trading Tools Accessible to All

In November, we launched our Bronze Membership, an affordable option that allows members to access our proprietary trading journal. This membership tier is perfect for traders who want to track their performance and start optimizing their strategies. By making our journal available to a wider audience, we’ve opened the door for more traders to experience the benefits of structured tracking and analysis. This initiative has been well-received, and we’re excited to see more members leverage this powerful tool.

A Warm Thank You to Our Members

As we close out 2024, we want to take a moment to express our heartfelt gratitude to all our members. Your dedication, passion, and resilience inspire us every day. Whether you’re just starting your trading journey or have reached advanced tiers, your progress and commitment fuel our mission to provide the best resources, tools, and support in the trading world.

From everyone here at FXC Academy, we wish you and your loved ones a Merry Christmas and a Happy New Year!

Looking ahead to 2025, we have exciting plans in store, including innovative tools, expanded resources, and even more opportunities to elevate your trading journey—stay tuned, as this will be our biggest year yet!

Your FXC Team

Exciting Upgrades at the Trading Floor

The Ultimate Trading Hub

We’re thrilled to announce some incredible upgrades to our trading floor, transforming it into a full-fledged trading hub where you can trade, relax, and connect with like-minded individuals. Whether you’re a pro trader or just getting started, we’ve built the perfect environment for balancing trading and off-screen time.

At its core, our trading floor is designed to help you stay focused on the markets, but we believe trading shouldn’t be all stress and no fun. That’s why we’ve added some great new features for those moments between trades, as well as essential tools to make your work setup top-notch.

Here’s what’s new and improved:

🖥️ 34 Professional Trading Desks for Multi-Monitor Trading

First and foremost, we haven’t forgotten the serious side of trading. We now provide fully equipped desks with up to 4 screens ideal for multi-monitor trading and analyzing multiple markets simultaneously. Whether you’re working on forex, stocks, crypto, or any other asset, you’ll have all the visual real estate you need to monitor charts, news, and trading platforms side by side. We provide a variety of four and two screen setups.

Our desks are optimized not only for trading but for any kind of office work—meaning you can set up your workspace exactly how you like it. Each workstation is spacious, comfortable, and designed for productivity, ensuring you can stay on top of your trades or any other business tasks with ease.

🎱 Pool Table & Table Tennis for Relaxation Between Trades

While waiting for that perfect trade, unwind with a friendly game on our new pool table or engage in some fast-paced action at our table tennis station. These games are not only great for relaxation but also help boost focus and patience, which are key for making smart trading decisions.

🏎️ Racing Simulators for Friendly Competition

We’ve also added racing simulators to our entertainment lineup! Perfect for those with a competitive streak, these simulators let you race against other traders and bring the thrill of competition to a whole new level. It’s an adrenaline rush that complements the intensity of the trading floor, helping you stay sharp while having some fun.

🎮 Xbox Console & Chill Area for Ultimate Downtime

For those moments when you need a full break from the action, we’ve introduced an Xbox console and Nintendo Switch in our chill area. Whether you want to play FIFA, explore some virtual worlds, or just sit back and relax with your fellow traders, this space is all about unwinding after a long trading session or while waiting for the markets to turn in your favor.

The Ultimate Trading Hub

Welcome to the trading hub area—a space that goes beyond just trading. Here, you can collaborate with other traders, share ideas, and enjoy some well-deserved breaks, all while having access to 34 high-performance desk setups for serious work. It’s the perfect blend of business and pleasure, designed to make trading more enjoyable and social.

We’re open to all traders throughout the week, and there’s no requirement to use our 50Cal strategy to join. Whether you’re working on your own strategy or exploring new opportunities, every trader is welcome here.

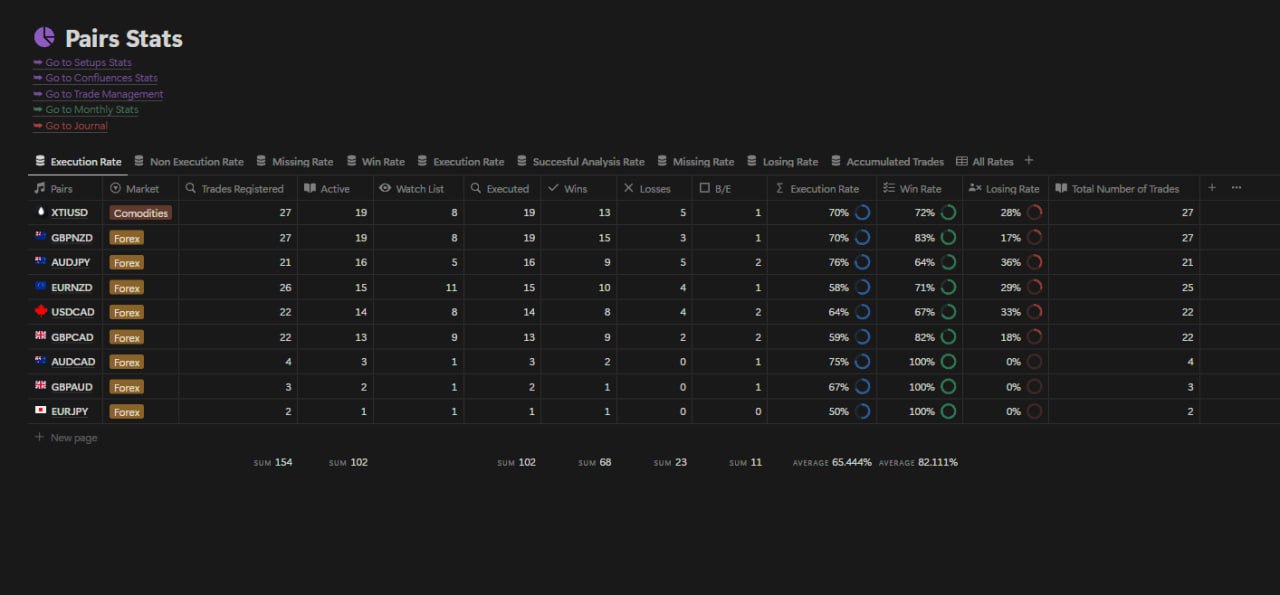

New Bronze Membership: Your Ultimate Proprietary Trading Journal

We are excited to announce the launch of our Bronze Membership at FXC Academy, offering exclusive access to our Tier 3 proprietary journal specifically designed for traders using the 50Cal strategy. This journal is a game-changer, meticulously crafted with over 10 unique and comprehensive tabs that analyze your trades, performance, and strategy. Whether you’re trading Forex, Stocks, Crypto, or Options, this journal is your new trading companion.

Here’s what makes our journal stand out:

🚀 Fully Responsive Design, Optimized for All Devices

The journal features a fully responsive design, ensuring seamless performance on any device, whether you’re on a mobile, tablet, or desktop. No matter where you are or what screen you’re using, you can count on an optimized experience.

🧠 Automated Data Analysis with Notion

Built with automated data analysis, the journal supports all asset types. Simply input the target and outcome of your trade, and the system will handle the rest. It’s synced across all your data to give you a complete view of your strengths and weaknesses.

📊 Powerful Built-in Charts to Track Trading Performance

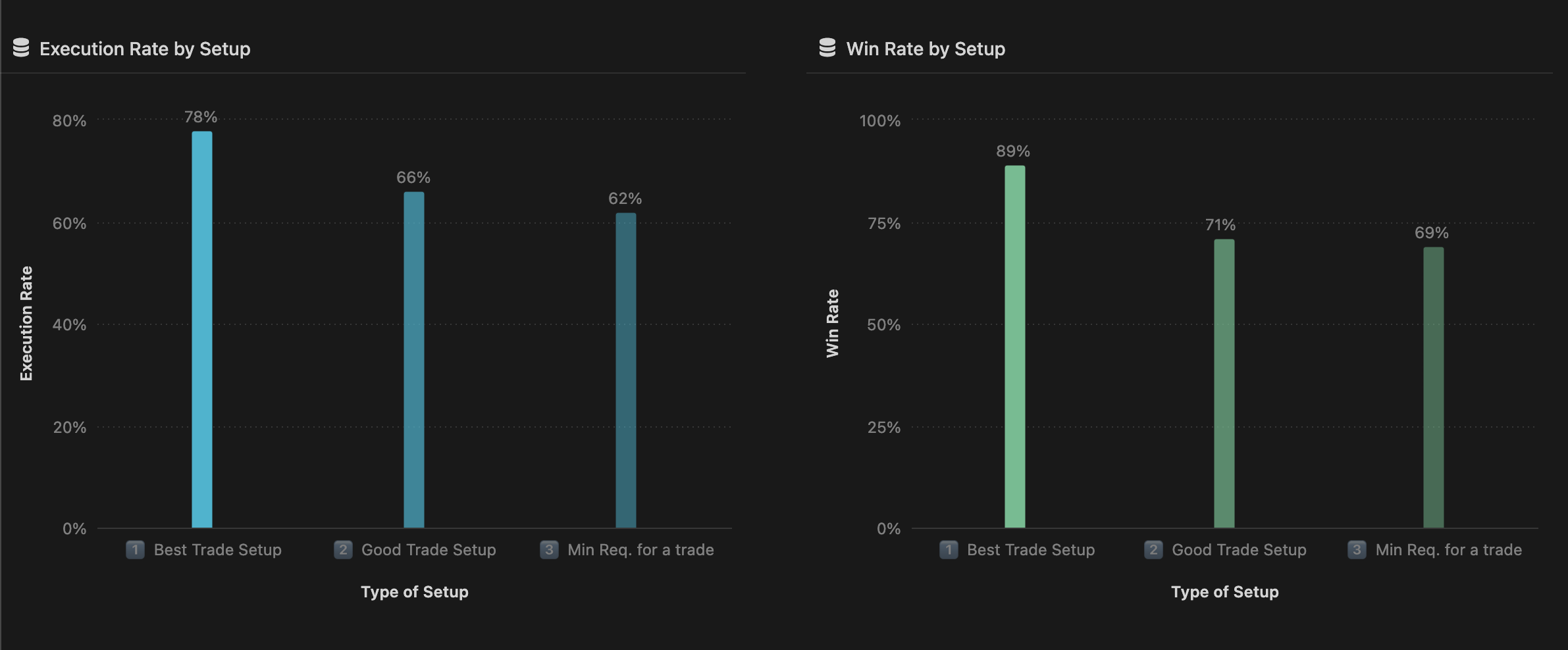

We’ve integrated built-in charts to help you visualize and track your trading performance. You can easily spot areas of improvement by reviewing:

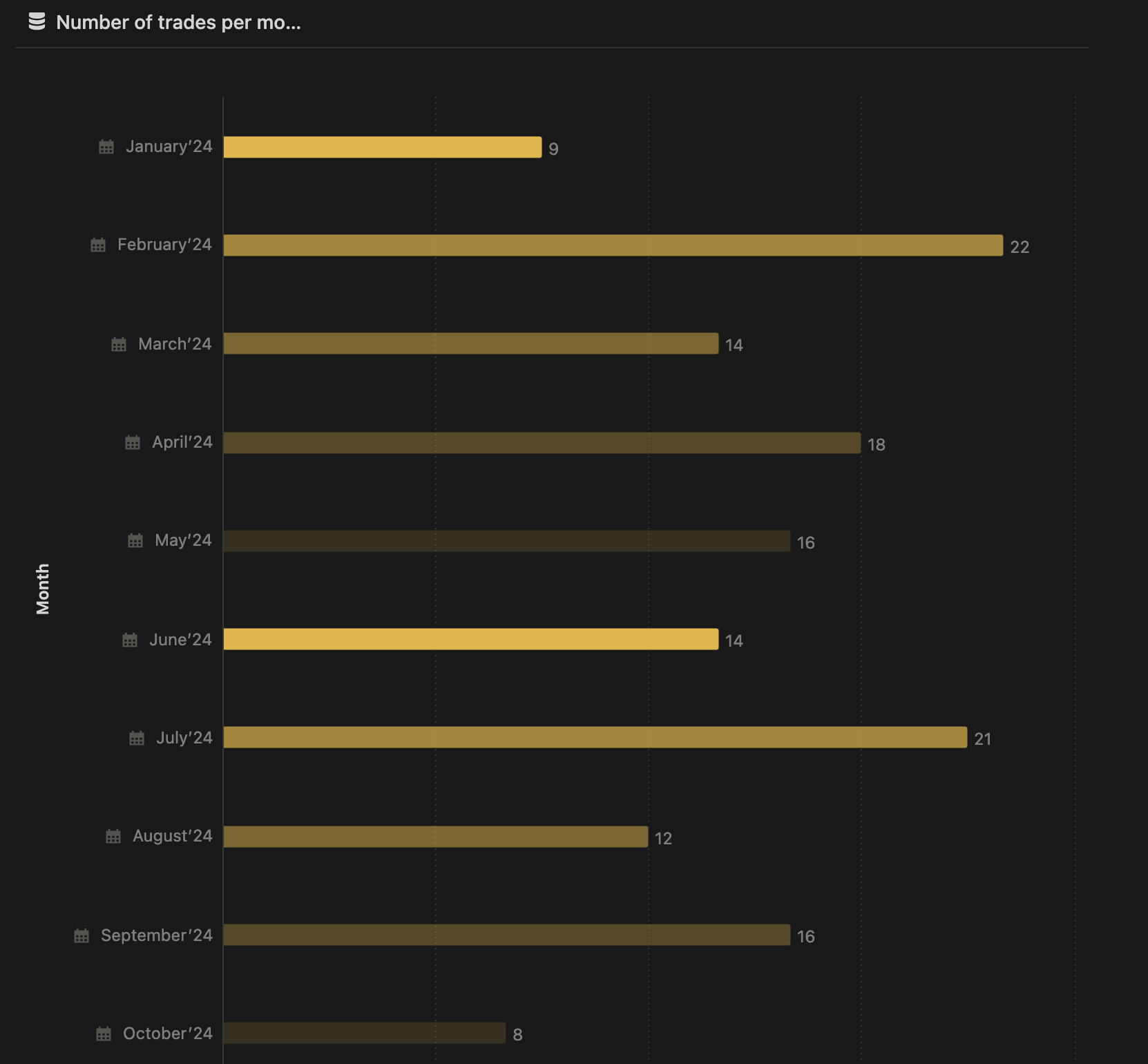

📊 Monthly Statistics

Track the number of trades per month and identify patterns in your performance.

🛠️ Customizable Dashboard for Strategy Optimization

One of the journal’s standout features is its customizable dashboard. Tailor it to fit your specific trading style, giving you full control over how you track and analyze your trades. This tool empowers you to refine and adjust your strategy for better results.

🤖 Notion AI Integration for Accurate Insights

With Notion AI integrated directly into the journal, you’ll have access to the most accurate and insightful data. Notion AI ensures that every trade, analysis, and metric is detailed and comprehensive, so you can make informed trading decisions.

🖥️ Side-Peak View for Quick Trade Snapshots

Efficiency is key, which is why we’ve added a Side-Peak view feature. This allows you to quickly view snapshots of charts for each trade, so you can easily review the before-and-after scenarios without wasting time.

💼 Proven by the FXC Academy Community

This proprietary journal has already been put to the test by our FXC Academy Community since January 2024, and its performance speaks for itself. Traders who have used the journal report better data analysis, improved trade management, and more confidence in their decision-making processes.

📞 24/7 Support

Need help with your journal? We provide 24/7 support, ensuring you can always rely on us for assistance as you explore and refine your trading data. The journal also comes with explanation videos that walk you through all its features, showing you how to use it most efficiently. Additionally, each tab in the journal includes an information icon that provides clear guidance on what data should be tracked in the corresponding columns, ensuring you get the most out of every feature.

The FXC Academy Proprietary Journal was developed in collaboration with our team of analysts and experienced traders to ensure it meets the precise needs of our community. We worked closely with Seb, our Head Analyst, who contributed invaluable insights from his years of trading expertise. Additionally, the journal was meticulously programmed and designed by Silver Analyst Daniel Erhan, whose deep understanding of the 50Cal strategy helped tailor the tool to fit the specific demands of our academy members. Together, they’ve crafted a journal that not only enhances trade analysis but also supports traders in refining their strategy for long-term success.

If you’re looking to improve your trading, enhance your analysis, and track your performance like never before, the FXC Academy Bronze Membership is for you. With powerful features designed specifically for 50Cal traders, this journal will become an invaluable tool in your trading arsenal. This exclusive journal is available through our Bronze Membership for just £9 per month, offering incredible value for traders looking to enhance their performance and analysis.

Our Open Day on the Trading Floor

A Day of Community and Inclusion

Yesterday we hosted an exciting Open Day at our trading floor, bringing together some of the most influential voices in the trading community. We were thrilled to welcome prominent trading influencers such as Zaki and Sam Gilkes, and many others to join us in celebrating the inclusivity of our trading environment. This event emphasized that our trading floor is open to all strategies and all traders—not just those focused on FXC.

To celebrate, we awarded three $100,000 challenge accounts throughout our open day to the winners of each competition round! Each challenge presented a unique opportunity for traders to showcase their strategies and trading knowledge under time pressure and strive for the highest returns. With each win. This event wasn’t just about competition—it was about recognizing talent and commitment in the trading community. We’re excited to see how these winners will leverage their new accounts and take their trading skills to the next level!

Kicking Off the Day

The day began with an engaging introduction, where we explored various trading strategies. Our guests shared their insights and experiences, sparking discussions that highlighted the diverse approaches traders can take. It was an incredible opportunity to learn from one another and appreciate the different paths that lead to trading success.

One of the highlights of the morning was a lively trading quiz that tested our knowledge and understanding of the market. The competition was fierce, but ultimately, Dan, a member of Leon’s MCR Trading community, emerged victorious, showcasing his impressive trading acumen.

A particularly interesting take away from the quiz was the role of the USDollar as the world’s reserve currency. Participants noted that if you were to ask for characteristics or attributes related to trading, the USDollar would often “pay the tab.” This sparked conversations about its influence on global markets and trading strategies, reinforcing the importance of understanding economic fundamentals in trading.

Afternoon Talks and Lunch at The Engine Room

As the day progressed, we enjoyed a delicious lunch at our campus canteen, affectionately known as The Engine Room. This setting allowed for more casual conversations and networking among traders. Our guests shared valuable experiences and strategies over lunch, further fostering a sense of community and collaboration.

Trading Competition

We recently held an intense 30-minute trading challenge to see who could achieve the highest returns in record time. The competition was fierce, with participants employing their best strategies to maximize gains in this high-stakes environment. After a flurry of trades, it was Sam Gilkes, also known by his trading alias “Trenlines,” who emerged victorious with an impressive 19% gain. In recognition of his achievement, along with other top performers, we awarded him a coveted $100,000 challenge account.

Racing Simulator Competition

As part of our open day excitement, we hosted a high-speed racing sim competition to see who could set the fastest lap time. The competition was intense, with participants pushing their virtual cars to the limit. Ultimately, it was our own trading floor member, Olly, who took the top spot with an impressive lap time of 1:33. His victory not only earned him the bragging rights of the fastest lap but also a $100,000 challenge account. This win showcases the spirit of focus and precision, both on the track and in trading. We’re thrilled to reward Olly’s achievement and can’t wait to see how he leverages this prize!

Fun and Games at The Armoury

To wrap up the day, we headed to The Armoury for some fun activities. Our participants engaged in thrilling challenges such as axe throwing, archery, and even battles on the big bean. These activities not only provided a fantastic break from trading but also encouraged teamwork and camaraderie among traders, influencers, and staff alike.

A Heartfelt Thank You

We would like to extend our heartfelt thanks to everyone who attended and participated in our Open Day. It was a fantastic opportunity to celebrate our diverse trading community and to remind ourselves that our trading floor is a space for everyone, regardless of their trading style.

We hope to see all of you back on the trading floor soon, ready to share ideas, strategies, and maybe even a few more fun activities. Here’s to a thriving trading community that welcomes all!

FOMC Live Recap: How Sebastien Predicted the Market

Ahead of last week’s key FOMC (Federal Open Market Committee) meeting, Sebastien, our Head Trader, delivered sharp insights into why he anticipated a 0.5% interest rate cut and how that outlook tied into the recent uptrend in Gold. Not only did he break down the underlying fundamentals driving the market before the event, but he also live traded the event with our members, guiding them through the volatility in real time.

Here’s a summary of the key points Sebastien shared before the meeting and how they aligned with market movements:

Why Sebastien Expected a 0.5% Rate Cut

1. Market Sentiment Shifting Toward 0.5%:

Sebastien highlighted how market sentiment had shifted toward expecting a more aggressive cut of 0.5%. This move, in his view, was essential to respecting the initial DOT plot (the Fed’s projections for interest rates).

2. Fundamental Data Signaling USD Weakness:

– Employment Data: The U.S. jobs market had weakened, with job numbers declining from 206K to 142K and unemployment rising from 4.1% to 4.2%. These are typically bearish signals for the USD, setting the stage for a rate cut.

– Inflation (CPI): While core CPI rose slightly from 0.1% to 0.3%, year-on-year CPI dropped from 3.0% to 2.5%. Sebastien saw this as another USD-bearish signal, making it more likely the Fed would intervene with a larger rate cut.

– ISM Data: The ISM Manufacturing Index dropped from 48.5 to 47.2, reflecting contraction, while ISM Services edged up from 48.8 to 51. Although ISM Services pushed above contraction levels (slightly bullish for USD), the broader picture leaned bearish for the dollar.

3. Market Behavior Pre-FOMC:

– US 2-Year Treasury Yield: The yield had fallen from 4.3% to 3.6%, indicating bearish sentiment for USD, as lower yields typically reduce demand for the currency.

– Stock Market Surge: Meanwhile, the stock market had rallied, with the S&P 500 hitting new all-time highs (ATH). This stock market strength, while typically USD bullish, didn’t align with the other indicators signaling a weakening USD.

Why This Meant a Bullish Gold Outlook

Sebastien connected these economic signals to the recent surge in gold prices. The overall bearish sentiment toward the USD and uncertainty around inflation had been fueling demand for gold as a safe-haven asset. The likelihood of a deeper rate cut (0.5%) would weaken the dollar further, driving investors into gold.

Live Trading FOMC with Sebastien

During the FOMC event, Sebastien led our members through the action in real-time. His analysis played out almost exactly as anticipated:

– The Fed’s decision was closely watched, and when the market leaned toward a 0.5% cut, gold surged in response.

In his words: “A 0.5% cut, along with a more dovish tone from the Fed, was the reasonable choice to address the current economic conditions and reassess the DOT plot. The market expected this, so a 0.25% cut would’ve been bullish for USD. But the Fed aligned with expectations, setting up a softer landing scenario that continued to fuel gold’s rally.”

Key Takeaways

Sebastien’s ability to combine fundamental analysis with live trading insights provided incredible value to members during this highly anticipated event. His deep dive into the labor market, inflation, and bond yields all pointed toward a weaker USD and a bullish trend in gold, which he executed on successfully in the live session.

Missed out on this live trading session? Don’t worry—you can still join Sebastien and the team for future events by becoming a Gold Member. Trading with real-time insights, particularly during major economic releases, can make all the difference in navigating volatile markets.

When to Stay Away in Trading

Capital Preservation

Trading in the stock market can be exhilarating, especially when the market is booming and profits seem to be just around the corner. However, seasoned traders know that it’s not always about riding the waves; sometimes, the best strategy is knowing when to step back and let the storm pass. Here’s why and when you should consider staying away from trading, particularly when all stocks are crashing.

Recognizing the Signs of a Market Crash/ Downside

A market crash is characterized by a sudden and severe drop in stock prices across the board. This can be triggered by various factors such as economic downturns, geopolitical tensions, natural disasters, or a pandemic. Here are some signs that the market is heading for a crash:

– Rapid and Unpredictable Declines: When stock prices are falling sharply and unpredictably, it often indicates panic selling.

– Negative News Overload: Continuous negative news cycles about the economy, politics, or other major issues can exacerbate the market downturn.

Why Staying Away Can Be Beneficial

A market crash is characterized by a sudden and severe drop in stock prices across the board. This can be triggered by various factors such as economic downturns, geopolitical tensions, natural disasters, or a pandemic. Here are some signs that the market is heading for a crash:

– Rapid and Unpredictable Declines: When stock prices are falling sharply and unpredictably, it often indicates panic selling.

– Negative News Overload: Continuous negative news cycles about the economy, politics, or other major issues can exacerbate the market downturn.

Preservation of Capital

In a crashing market, the primary goal should be to preserve your capital. By staying away, you avoid the risk of further losses and have funds available to invest when the market stabilizes.

Reduced Emotional Stress:

Trading during a market crash can be emotionally taxing. The stress of watching your investments plummet can lead to irrational decision-making, resulting in even greater losses.

Avoiding Panic Selling:

Panic selling is a common reaction during market crashes. By staying away, you give yourself time to avoid making impulsive decisions that could harm your long-term financial goals.

When to Re-Enter the Market

Patience is key in trading, and knowing when to re-enter the market can make all the difference. Here are some indicators that it might be safe to start trading again:

Market Stabilization:

Look for signs that the market is stabilizing. This could include a reduction in volatility, positive economic news, and a general upward trend in stock prices.

Technical Analysis:

Use technical analysis tools to identify potential buy signals. Look for patterns, support and resistance levels, and other indicators that suggest the market is turning around.

Practical Tips for Practicing Patience

Set Clear Goals:

Define your investment goals and risk tolerance. Knowing what you’re aiming for can help you stay focused and patient during turbulent times.

Diversify Your Portfolio:

Diversification can reduce risk and help protect your investments from market volatility.

Stay Informed:

Keep up with market news and trends, but avoid information overload. Focus on reliable sources and avoid getting swayed by every piece of negative news.

Use Stop-Loss Orders

Implementing stop-loss orders can protect your investments by automatically selling stocks when they reach a certain price, minimizing potential losses.

Conclusion

In the world of trading, sometimes the best move is no move at all. Staying away from the market during a crash can protect your capital, reduce emotional stress, and provide you with the opportunity to strategize for the future. By practicing patience and waiting for the market to settle, you can position yourself to make more informed and potentially profitable trades in the long run. Remember, in trading, patience isn’t just a virtue—it’s a strategy.

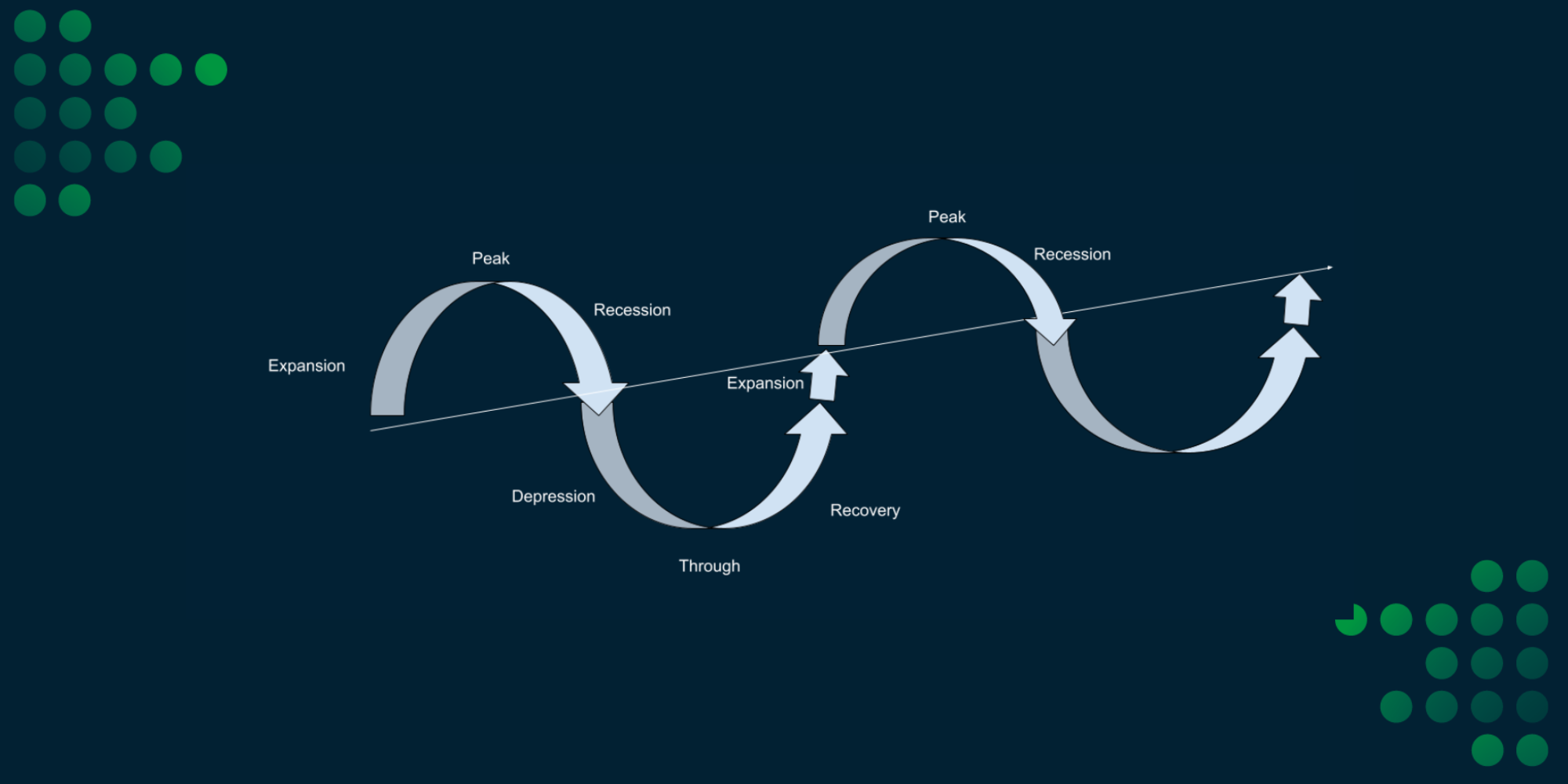

Economic Cycle

Phases of the Economic Cycle

The variations in economic activity that an economy experiences over time are referred to as the economic cycle, often called the business cycle. Periods of growth, peak, contraction, and trough define it. These cycles show shifts in a number of economic metrics, including employment rates, consumer spending, investment, inflation, and GDP (Gross Domestic Product).

Expansion

Economic growth is portrayed by expanding GDP (gross domestic product), increasing work rates, high consumer confidence, and expanded business investment. During an expansion, businesses flourish, creation expands, and there’s generally an upward pattern in financial indicators.

Peak

The peak is the highest point of the economic cycle. It’s the time of maximum growth, elevated degrees of economic activity, and frequently over-the-top optimism. Inflationary pressures and market imbalances may occur as the economy reaches its peak. The stock exchange can be characterised to be in an irrational exhilaration.

Contraction

Otherwise called recession, this stage includes a decrease in financial movement. It’s portrayed by falling gross domestic product, rising joblessness, diminished buyer spending, and a reduction in business investment. Contractions can prompt diminished trust in the economy and monetary difficulty for organisations and people. In this phase, stocks enter a bear market.

Trough

The trough is the absolute bottom of the financial cycle. When conditions are at their worst and economic activity is at its lowest point. Nonetheless, it likewise marks the change directly from contraction toward recovery.

Recovery

In the wake of arriving at the trough, the economy starts to recuperate. This stage includes an expansion in monetary action, rising gross domestic product, diminishing joblessness rates, and the arrival of consumer and business confidence. Recovery drives back to the expansion stage, beginning a new cycle.

These cycles are a characteristic piece of market economies and are impacted by different factors like financial policy, monetary approach, consumer confidence, technological advancement, and geopolitical events. Central banks frequently use policies and interventions to attempt to deal with these cycles and alleviate the unfavorable consequences of economic decline.

Do you want to learn more?

Stay True to Your Trading Plan: Ignore Noise & Focus on Strategy

In the bustling world of trading, where opinions fly as swiftly as market prices, it’s easy to get swept away by the noise. However, seasoned traders know that staying true to their plan amidst this is the key to success. In this blog post, we delve into the importance of not being influenced by other traders and sticking to one’s plan, despite the distracting chatter of the market. Let’s explore how to maintain focus, cultivate confidence in your strategy, and ignore the noise that can lead to impulsive decisions and missed opportunities.

The Temptation of Market Noise

Trading platforms, social media, and financial news outlets are awash with opinions, predictions, and market rumors. While some of this information can be valuable, much of it is noise, random fluctuations that can cloud judgment and lead to poor decision-making. The temptation to follow the crowd or chase the latest hot tip can be strong, but succumbing to it can spell disaster for your trading success.

The Importance of Sticking to Your Plan

A well-thought-out trading plan is the result of careful analysis and strategy development. Consistently following this plan, even in the face of uncertainty, builds discipline and fosters success over time. Sticking to your plan helps temper strong emotions evoked by market noise, such as fear of missing out (FOMO) or panic during periods of volatility. Adhering to your plan ensures that risk management protocols, such as stop-loss orders and position sizing, are implemented consistently.

Strategies for Ignoring Market Noise

Define Your Plan Clearly:

A well-defined trading plan outlines your strategy, including entry and exit criteria, risk management rules, and profit targets. Having a clear plan makes it easier to stay focused amidst market noise.

Limit Exposure to External Influences:

Reduce the temptation to succumb to market noise by limiting exposure to trading forums, social media, and financial news outlets. Focus on reputable sources of information and avoid the urge to constantly check for updates.

Trust Your Analysis:

Base your trading decisions on thorough analysis and research rather than the opinions of others. Trust in your own abilities and the validity of your strategy.

Practice Patience:

Avoid impulsive decisions by practicing patience and waiting for your trading signals to align with your plan. Rushing into trades based on market noise often leads to regrettable outcomes.

Keep a Trading Journal:

Maintain a trading journal to track your trades, document your rationale for each decision, and evaluate your performance over time. Reviewing your journal reinforces the importance of sticking to your plan.

Stay Disciplined:

Discipline is the bedrock of successful trading. Stick to your plan, even when faced with the temptation to deviate. Consistent discipline leads to consistent results.

The Power of Awareness

Being aware of the possibility of being influenced by market noise is already a significant step towards sticking to your own rules. Recognizing when external opinions or emotions are trying to sway your decisions empowers you to take control and reaffirm your commitment to your trading plan.

Conclusion

In the noisy world of trading, maintaining focus and sticking to your plan is paramount. Ignoring the distractions of market noise allows you to trade with clarity, confidence, and discipline—essential ingredients for long-term success. By defining your plan clearly, limiting exposure to external influences, trusting your analysis, and practicing patience and discipline, you can navigate the markets with resilience and achieve your trading goals. Remember, success in trading isn’t about following the crowd or reacting to every market rumor, it’s about staying true to your plan and executing it with conviction. So, tune out the noise, trust in your strategy, and let your disciplined approach lead you to success.

Exploring the Pros and Cons of Demo Accounts in Trading

Demo accounts are a valuable tool for traders at all levels, offering a risk-free environment to practice strategies, hone skills, and explore new markets. However, like any tool, demo accounts come with both advantages and disadvantages. In this blog post, we’ll delve into the pros and cons of demo accounts in trading to help you make informed decisions about their use.

Advantages of Demo Accounts

Risk-Free Environment:

One of the most significant advantages of demo accounts is that they allow traders to practice trading strategies and techniques without risking real money. This provides a safe space to experiment and learn without the fear of financial loss.

Skill Development:

Demo accounts are an excellent resource for traders looking to develop their skills and gain experience in the market. Whether you’re a beginner learning the basics of trading or an experienced trader testing new strategies, demo accounts offer valuable hands-on experience.

Market Exploration:

Demo accounts provide access to a wide range of financial markets and instruments, allowing traders to explore new markets and asset classes without committing real capital. This enables traders to diversify their trading portfolio and discover new opportunities.

Platform Familiarization:

Demo accounts allow traders to familiarize themselves with trading platforms and software offered by brokers. This ensures that traders are comfortable navigating the platform and executing trades efficiently when transitioning to live trading.

Disadvantages of Demo Accounts

Lack of Emotional Investment:

One of the main drawbacks of demo accounts is that traders may not experience the same emotions and psychological challenges associated with real-money trading. This can lead to a false sense of security and overconfidence in trading decisions.

No Real Financial Consequences:

Because demo accounts use virtual funds, traders may not fully appreciate the importance of risk management and capital preservation. Real-money trading involves real financial consequences, which can impact decision-making and risk tolerance.

Market Execution Differences:

While demo accounts simulate real market conditions, there may be differences in market execution and liquidity compared to live trading. Traders should be aware of these discrepancies when transitioning from demo to live accounts.

Potential for Overtrading:

The absence of real financial risk in demo accounts can lead to overtrading and unrealistic trading habits. Traders may take excessive risks or make impulsive decisions that they would not make with real money on the line.

Conclusion

Demo accounts are a valuable resource for traders to practice, learn, and refine their skills in a risk-free environment. However, it’s essential to recognize the limitations and potential pitfalls associated with demo trading. Traders should use demo accounts as a supplement to their overall trading education and transition to live trading with caution and discipline. By understanding the advantages and disadvantages of demo accounts, traders can maximize their effectiveness and make informed decisions about their trading journey.

Why Multiple Streams of Income are Crucial for Traders

In the world of trading, relying solely on a single source of income can be risky and unpredictable. The market’s inherent volatility and the constant ebb and flow of financial fortunes mean that traders must consider diversifying their income streams to ensure long-term stability and success. Here, we explore why having multiple streams of income is essential for traders and how it can enhance their financial resilience and growth.

Diversifying Risk

The most significant advantage of having multiple streams of income is risk diversification. Trading, by its nature, is fraught with risks. Market conditions can change rapidly, and a strategy that works well today might not be as effective tomorrow. By diversifying income sources, traders can mitigate the impact of a downturn in any single market or strategy. This diversification acts as a financial buffer, ensuring that even if one income stream underperforms, others can help maintain overall financial stability.

Enhancing Financial Stability

Multiple income streams contribute to greater financial stability. Trading income can be highly variable, with significant fluctuations based on market conditions, trading strategies, and individual performance. Supplementing trading income with other sources, such as investment dividends, rental income, or business ventures, provides a more stable and predictable financial foundation. This stability can reduce stress and allow traders to focus more effectively on their trading strategies without the constant pressure of financial uncertainty.

Capital Growth and Investment Opportunities

Having multiple streams of income allows traders to accumulate capital more quickly and take advantage of various investment opportunities. With additional income sources, traders can invest in long-term assets, such as real estate or stocks, which can provide passive income and appreciate over time. This approach not only diversifies their income but also helps in building wealth and securing financial independence.

Learning and Skill Development

Engaging in different income-generating activities can enhance a trader’s skills and knowledge base. For instance, managing rental properties or running a side business requires financial acumen, strategic planning, and risk management—all of which are valuable skills in trading. The cross-disciplinary knowledge gained from these activities can lead to improved decision-making and a more holistic understanding of financial markets and business operations.

Psychological Benefits

Trading can be a highly stressful and emotionally taxing activity. The pressure to consistently perform and the fear of significant losses can take a toll on a trader’s mental health. Multiple income streams can alleviate some of this pressure, providing a psychological cushion that allows traders to make more rational, less emotionally-driven decisions. Knowing that there are other sources of income can reduce the anxiety associated with trading, leading to better overall performance and well-being.

Long-Term Security

Relying solely on trading for income can be precarious, especially as market conditions change or personal circumstances evolve. Multiple streams of income provide a safety net that ensures long-term security. This security is crucial for planning major life events, such as retirement, education expenses, or unexpected financial needs. With diverse income sources, traders can build a more resilient financial future, capable of withstanding various economic cycles and personal challenges.

Encouraging Innovation and Creativity

Exploring different income streams can foster innovation and creativity. Traders who diversify their income often develop new ideas and strategies, both within trading and in other areas of their financial lives. This innovative mindset can lead to the discovery of unique trading opportunities, the development of new business ventures, or the creation of novel investment strategies. By continually seeking out and developing new income streams, traders can stay ahead of market trends and adapt to changing conditions more effectively.

Conclusion

In conclusion, multiple streams of income are not just beneficial but essential for traders looking to achieve long-term success and financial stability. By diversifying their income sources, traders can reduce risk, enhance financial stability, grow their capital, and develop valuable skills. Moreover, the psychological benefits and long-term security provided by multiple income streams allow traders to navigate the volatile world of trading with greater confidence and peace of mind.